Trading platforms have revolutionized the way traders buy and sell financial instruments such as stocks, commodities, and currencies. With the rise of online trading, these platforms have become a vital tool for investors looking to make informed decisions and execute trades quickly and efficiently. There are several popular trading platforms available in the market, each offering unique features and benefits to cater to the diverse needs of traders. In this article, we will compare some of the most popular trading platforms and help you decide which one is most suitable for your trading style and preferences.

1. MetaTrader 4 (MT4)

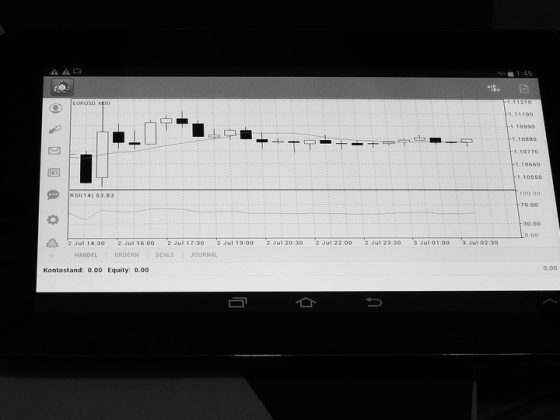

MetaTrader 4, also known as MT4, is one of the most widely used trading platforms in the world. It is highly regarded for its user-friendly interface, advanced charting tools, and a wide range of technical indicators. MT4 is ideal for both beginners and experienced traders who want to automate their trading strategies through Expert Advisors (EAs). The platform also allows traders to backtest their strategies and analyze market trends using historical data.

2. MetaTrader 5 (MT5)

MetaTrader 5 is the successor to MT4 and offers several additional features and improvements. MT5 has an enhanced trading interface, more advanced analytical tools, and a wider range of financial instruments to trade. The platform also supports more order types and timeframes, making it a popular choice among professional traders and institutions. MT5 is ideal for traders who require more complex trading strategies and analysis tools.

3. cTrader

cTrader is a powerful trading platform that offers advanced charting tools, real-time data, and fast execution speeds. The platform is known for its intuitive interface and user-friendly design, making it easy for traders to navigate and execute trades efficiently. cTrader also offers algorithmic trading capabilities through its cAlgo feature, allowing traders to develop and test their automated strategies. The platform is popular among traders who value speed and reliability in their trading activities.

4. NinjaTrader

NinjaTrader is a comprehensive trading platform that caters to both individual traders and institutional clients. The platform offers advanced charting tools, backtesting capabilities, and customizable trading strategies through its NinjaScript programming language. NinjaTrader also provides access to a wide range of markets, including stocks, futures, and forex, making it a versatile platform for traders with diverse interests. NinjaTrader is ideal for traders who require a high level of customization and control over their trading strategies.

5. TradingView

TradingView is a web-based trading platform that offers advanced charting tools, social trading features, and real-time data for a wide range of financial instruments. The platform is popular among traders who value collaboration and idea sharing, as it allows users to follow and interact with other traders through its social network. TradingView also offers a wide range of technical indicators and drawing tools, making it easy for traders to analyze market trends and make informed decisions. The platform is ideal for traders who prefer a web-based trading solution that can be accessed from any device with an internet connection.

FAQs

1. What is a trading platform?

A trading platform is a software application that allows traders to access financial markets and execute trades on various financial instruments such as stocks, commodities, and currencies. These platforms provide real-time data, charting tools, and order execution capabilities to help traders make informed decisions and manage their trading activities efficiently.

2. What are the key features to look for in a trading platform?

When choosing a trading platform, it is important to consider factors such as ease of use, charting capabilities, order types, trading instruments, and customer support. Traders should also look for platforms that offer competitive pricing, reliable execution speeds, and advanced analytical tools to enhance their trading experience.

3. Can I use multiple trading platforms simultaneously?

Yes, traders can use multiple trading platforms simultaneously to access different markets, test different strategies, or take advantage of specific features offered by each platform. However, it is important to ensure that each platform is compatible with your trading style and preferences to avoid confusion or errors in your trading activities.

4. How do I choose the right trading platform for my needs?

To choose the right trading platform for your needs, consider factors such as your trading experience, preferred trading instruments, desired features, and budget. It is also helpful to demo test multiple platforms to compare their usability, functionality, and performance before making a final decision. Additionally, seek feedback from other traders or industry experts to gain insights into the strengths and weaknesses of each platform.

In conclusion, trading platforms play a crucial role in the success of traders by providing the tools and resources needed to make informed decisions and execute trades efficiently. By comparing popular trading platforms and understanding their features and benefits, traders can choose a platform that aligns with their trading style and preferences. Whether you are a beginner or experienced trader, investing in a reliable and user-friendly trading platform can enhance your trading experience and help you achieve your financial goals.