1. Market order: A market order is a request from a trader to buy or sell a security at the best available price. Market orders are executed immediately at the current market price.

2. Limit order: A limit order is a request from a trader to buy or sell a security at a specified price or better. The order will only be executed if the market reaches the specified price.

3. Stop order: A stop order is a request from a trader to buy or sell a security once the market reaches a specified price, known as the stop price. This order is used to limit losses or protect profits.

4. Bid price: The bid price is the highest price that a buyer is willing to pay for a security. It represents the demand side of the market.

5. Ask price: The ask price is the lowest price that a seller is willing to accept for a security. It represents the supply side of the market.

6. Spread: The spread is the difference between the bid price and the ask price of a security. It represents the transaction costs for trading that security.

7. Volatility: Volatility refers to the degree of price fluctuations in a security or market. High volatility can present trading opportunities but also increases the risk of price swings.

8. Liquidity: Liquidity refers to the ease with which a security can be bought or sold without affecting its price. Highly liquid securities have a high volume of trading activity.

9. Margin: Margin is the amount of money that a trader must put up to open a position in a margin account. It allows traders to leverage their capital and potentially increase their profits, but also increases the risk of losses.

10. Leverage: Leverage is the use of borrowed funds to increase the size of a trade. It can amplify both gains and losses, so it should be used cautiously.

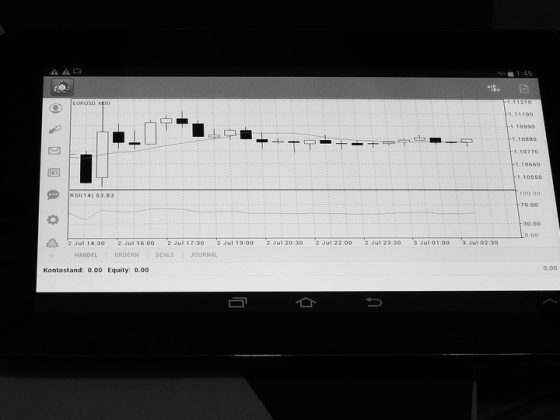

11. Technical analysis: Technical analysis is the analysis of historical price data and volume to predict future price movements. It is based on the belief that price patterns repeat themselves over time.

12. Fundamental analysis: Fundamental analysis is the analysis of a security's underlying financial and economic factors, such as earnings, revenue, and market conditions. It is used to determine the intrinsic value of a security.

By familiarizing yourself with these key terms and concepts, you can gain a better understanding of the markets and make more informed trading decisions. Remember that trading involves risk, so it is important to do your own research and develop a solid trading plan before diving into the markets. With the right knowledge and preparation, you can increase your chances of success as a trader.