If you want to deepen your understanding of investing and the stock market, some of the greatest minds in finance have written books to guide beginners and experienced investors. Here are our top 5 books about investing and the stock market, covering strategies, and the mindset required to be successfull in this world. We read everyone of these books and can only recommend them!

1. “One Up on Wall Street” by Peter Lynch

Peter Lynch, legendary manager of the Magellan Fund at Fidelity Investments, delivers timeless wisdom in One Up on Wall Street. This book emphasizes the power of individual investors to beat the pros by simply observing the world around them. Lynch highlights how spotting trends early and understanding companies you interact with daily can lead to lucrative investment opportunities.

Key takeaway: Invest in what you know, but make sure you thoroughly research the fundamentals before jumping in.

2. “The Warren Buffett Way” by Robert G. Hagstrom

Even if this book is not written by Warren Buffett himself, this is a must-read. You’ll dive into Buffett’s approach to identifying great companies, buying them at fair prices, and holding them for the long haul. It also talks about his principles, like understanding and valuing the business. All very useful stuff.

Key takeaway: Building wealth in the stock market requires patience and a long-term mindset.

3. “The Intelligent Investor” by Benjamin Graham

This is the Bible of investing, Benjamin Graham’s The Intelligent Investor is a must-read for anyone serious about investing. Graham introduces concepts like “margin of safety” and differentiates between investing and speculating. His wisdom traveled through time and and his advice are still great today.

Key takeaway: Avoid emotional decision-making, and focus on buying undervalued securities to minimize risk while maximizing potential returns.

4. “100 Baggers: Stocks That Return 100-to-1 and How to Find Them” by Christopher W. Mayer

100 Baggers explores the rare and rewarding phenomenon of stocks that grow 100 times in value. Christopher Mayer studies companies that achieved this feat and outlines the characteristics they share—such as strong growth potential, a durable competitive advantage, and long holding periods. This book inspires investors to think big and aim high while staying grounded in research.

Key takeaway: To achieve extraordinary returns, find exceptional companies and hold on to them for the long haul.

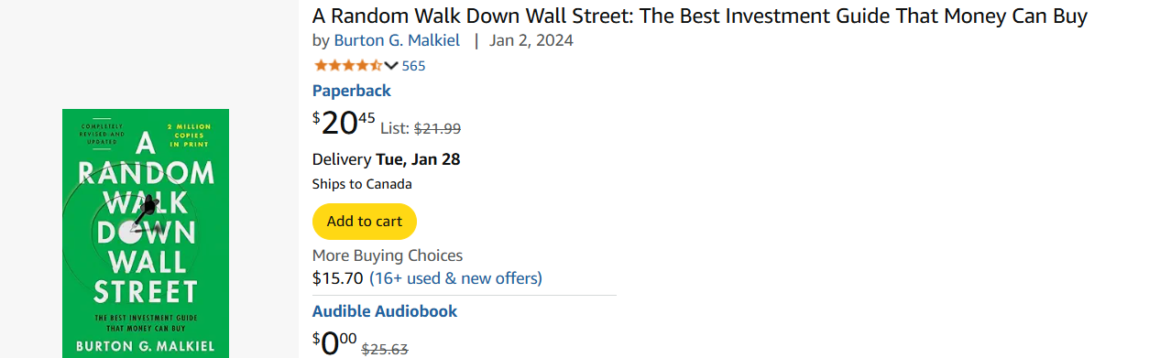

5. “A Random Walk Down Wall Street” by Burton G. Malkiel

If you’re trying to decide between being an active investor or taking the passive route, A Random Walk Down Wall Street is definitely worth checking out. Burton Malkiel, the author, makes a strong case that the stock market generally runs pretty efficiently. That means it’s tough for those active investors to consistently come out on top. Instead, he suggests that you can’t go wrong with low-cost index funds—they’re a reliable way to grow your money over time without the constant hustle.

Key takeaway: Most folks will find that passive investing with a focus on diversification and keeping fees low is a smart strategy. But hey, it might not be the right choice for everyone!

Final thoughts

These five books each bring something different to the table. No matter if you’re just starting out in the world of investing or looking to sharpen your skills, these reads can help you build the knowledge and confidence to make smarter investment moves.

So, which one are you thinking of picking up first?

This was the “Top 5 books about investing and the stock market”. Did you like it? Tell us!