Yes, I am sure you all remember this story! In the world of high-tech startups, few stories have been as dramatic as that of Nikola Motors. Founded in 2014 by Trevor Milton, Nikola set out to revolutionize the trucking industry with hydrogen-powered and electric vehicles. The company’s promise to transform the future of transportation, combined with bold ambitions and a charismatic founder, captured the attention of investors, industry leaders, and the media. However, what seemed like a meteoric rise soon spiraled into a spectacular crash fueled by deception, lies, and regulatory scrutiny. So, this is the story about the rise and crash of Nikola Motors, enjoy!

The Vision and Early Success

Nikola Motors was founded on the idea of creating a sustainable future for the transportation sector, specifically by designing electric and hydrogen-powered trucks (an quite good looking trucks I have to say). Milton’s vision was grand: he aimed to disrupt the diesel-heavy trucking industry with clean, green energy solutions. Early on, the company attracted significant attention, with claims that Nikola’s trucks would outperform traditional vehicles in every way imaginable. It would offer better efficiency, lower operating costs, and a smaller environmental footprint.

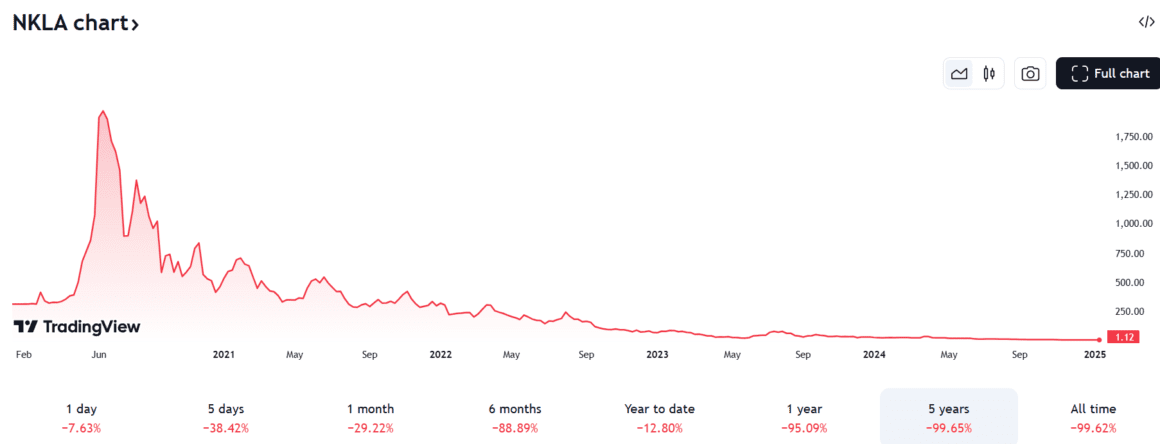

Nikola went public in June 2020 through a reverse merger with a SPAC (I know you love it), becoming a $30 billion company almost overnight (with no revenues yet…). The deal marked a high point in the company’s brief history, with shares surging to record levels. Investors were eager to jump on the bandwagon, and Nikola’s future appeared as bright as ever.

Trevor Milton: The Visionary or the Conman?

At the heart of Nikola’s rise was Trevor Milton, the company’s founder and former CEO. Milton, a charismatic and media-savvy entrepreneur, presented himself as the visionary leading the charge in clean energy innovation. He often spoke with great passion about Nikola’s technology, promising investors that the company’s trucks would redefine the industry.

Milton’s larger-than-life persona and persuasive ability earned him a devoted following, with his promises of cutting-edge technology drawing attention from major automakers, investors, and government officials. He presented Nikola’s hydrogen fuel cell technology as a game-changer and touted deals with the likes of Anheuser-Busch and GM, which seemed to validate his vision.

But behind the scenes, Milton’s claims were increasingly dubious. Many of the company’s public statements and high-profile announcements turned out to be exaggerated or outright false.

The Lies and Deception

In September 2020, just months after Nikola’s successful IPO, a bombshell report by the short-selling firm Hindenburg Research accused the company of being an elaborate fraud. The report alleged that Nikola had misled investors about the capabilities of its trucks, including claims that its hydrogen-powered trucks were operational when, in fact, they were not. The most notorious claim in the report centered around a viral video of a Nikola truck driving down a hill, which Nikola had claimed demonstrated the vehicle’s functionality. In reality, the truck was rolling downhill without any power from its hydrogen system (just imagine the team of “engineers” pushing the truck at the top of the hill…)—an embarrassing revelation that called into question the authenticity of much of the company’s marketing.

The allegations were damning. Nikola was accused of misleading investors with false statements about its technology, partnerships, and the true state of its vehicles. Milton’s claims about working prototypes, revolutionary fuel cell technology, and soon-to-be-delivered trucks were shown to be fabrications designed to inflate the company’s value and generate hype.

In response, Nikola’s stock price plummeted (look at the graph, -99.65% from all time high), and the company found itself under investigation by both the Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) for potential securities fraud.

Then, The Fall From Grace

As the investigations into Nikola intensified, Milton resigned in September 2020, just weeks after the Hindenburg report was released. His departure did little to stop the company’s decline, and Nikola’s stock continued to crater. It became clear that much of the technology the company had promised was still years away from reality.

In July 2021, Milton was charged with securities fraud and wire fraud by the U.S. government. Prosecutors alleged that he had made false and misleading statements to investors, inflating the company’s prospects and technology to boost its stock price. Nikola’s shares, which had once soared to over $90 per share, were now trading below $10.

Milton’s trial began in September 2022, and in early 2023, he was found guilty of three counts of fraud. The case was a reminder of the lengths to which some entrepreneurs will go in the pursuit of success.

Finally, the aftermath and legacy

Nikola Motors continues to operate today, but its prospects are far from the groundbreaking future once envisioned by Milton. The company has shifted its focus to building real vehicles, including hydrogen-powered trucks, but its reputation has been irreparably damaged. Nikola has struggled to gain traction with its products, and its stock price remains far below its peak.

Trevor Milton, once heralded as a visionary, now stands as a cautionary tale of the dangers of over-promising and under-delivering. His actions cost investors billions of dollars and shattered the trust in his company.

So, This was The Rise and Crash of Nikola Motors. Did you like it? Then please, Tell us!