Trading economics is a fascinating field that involves the study of financial markets, macroeconomic trends, and the impact of government policies on the economy. For beginners, understanding the basics of trading economics can seem overwhelming, but with some guidance, anyone can grasp the essential concepts and start trading with confidence.

What is Trading Economics?

At its core, trading economics involves the buying and selling of financial assets, such as stocks, bonds, commodities, and currencies, with the goal of making a profit. Traders analyze economic indicators, market trends, and other factors to make informed decisions about when to buy or sell assets.

Trading takes place on various platforms, such as stock exchanges, forex markets, and commodity markets, where individuals and institutions buy and sell financial instruments. These markets operate 24/7, providing ample opportunities for traders to enter and exit positions at different times.

Key Concepts in Trading Economics

To succeed in trading economics, it's essential to understand some key concepts that drive financial markets and influence trading decisions. Here are a few fundamental concepts to get started:

1. Supply and Demand: Prices of financial assets are determined by supply and demand in the market. When there is high demand for an asset, its price typically rises, and vice versa.

2. Economic Indicators: Economic indicators, such as GDP, inflation, employment data, and consumer confidence, provide valuable insights into the state of the economy. Traders use these indicators to gauge market conditions and make informed trading decisions.

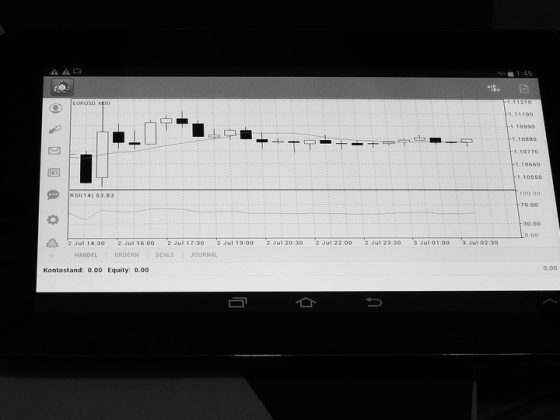

3. Technical Analysis: Technical analysis involves studying historical price movements and patterns to predict future price movements. Traders use charts, graphs, and technical indicators to identify trends and entry/exit points.

4. Fundamental Analysis: Fundamental analysis involves studying economic, financial, and geopolitical factors that influence asset prices. Traders analyze company earnings reports, government policies, and global events to make informed trading decisions.

5. Risk Management: Risk management is crucial in trading economics to protect capital and minimize losses. Traders use stop-loss orders, position sizing, and other risk management tools to manage their exposure to market volatility.

FAQs about Trading Economics for Beginners

As a beginner in trading economics, you may have several questions about how to get started and navigate the complexities of financial markets. Here are some frequently asked questions about trading economics:

Q: How much money do I need to start trading?

A: The amount of money needed to start trading depends on the type of assets you want to trade and your risk tolerance. You can start trading with as little as a few hundred dollars in the forex or options market, but trading stocks or commodities may require a larger investment.

Q: How can I learn more about trading economics?

A: There are many resources available to help you learn about trading economics, such as online courses, books, webinars, and seminars. You can also practice trading with a demo account to gain experience before trading with real money.

Q: What are the risks involved in trading economics?

A: Trading economics involves inherent risks, such as market volatility, economic events, and geopolitical uncertainty. It's crucial to understand the risks and have a solid risk management strategy in place to protect your capital.

Q: How do I choose a trading platform?

A: When choosing a trading platform, consider factors such as fees, trading tools, customer support, and security measures. Look for a platform that meets your trading needs and offers a user-friendly interface.

Q: How can I stay updated on market trends and economic news?

A: To stay updated on market trends and economic news, you can follow financial news websites, subscribe to market analysis reports, and participate in trading forums. It's essential to stay informed about market events that can impact your trading decisions.

In conclusion, trading economics offers a wealth of opportunities for traders to profit from financial markets and navigate economic trends. By understanding the basics of trading economics, conducting thorough research, and practicing risk management, beginners can embark on a rewarding trading journey. Remember to stay informed, stay disciplined, and stay focused on your long-term trading goals to succeed in trading economics.