It can seem daunting and time-consuming to pick individual stocks, and many stock-picking services tend to focus on a specific strategy such as growth or dividends. This Motley Fool Epic review shows how you can receive five monthly recommendations for multiple investment strategies.

You will receive insights from several Motley Fool services, including their premium ratings and research tools. As a Motley Fool subscriber, I share my feedback on the potential perks and who’s the ideal investor for Epic.

Summary

The Motley Fool is a well-known source of stock investment information. With Motley Fool Epic, you’ll have access to five stock picks each month. These picks can help investors find potential winners without putting too much time into research.

Pros

- Five monthly stock picks

- Easy to implement

- Track record of success

Cons

- Annual fee

- No short-term picks

- No guaranteed success

What is Motley Fool Epic?

Motley Fool Epic is the second of five levels of The Motley Fool investment newsletters. I like that it provides five monthly recommendations for aggressive, moderate, and cautious investing styles. The recommendations feature well-known companies and lesser-known ones with high growth potential.

In comparison, most newsletters only provide one monthly pick and have a narrow investment strategy. The Motley Fool recommends this service for portfolios of $50,000 or more. You may also consider upgrading if you already use Motley Fool Stock Advisor but want more insights.

Further, in an industry full of scams, it is reassuring to know that The Motley Fool offers a proven track record with products designed for individual investors ready to invest for three to five years. Instead of dealing with pump-and-dump schemes, you have useful tools for everyday investors.

I also like that this product provides in-depth ratings and AI-powered research tools that reduce your reliance and subscription costs on other top-notch investment websites.

How Does Motley Fool Epic Work?

You are cutting out the major time commitment that is typically involved with stock research when you sign up for Motley Fool Epic. Instead, the service will handle the bulk of the research for you:

- Five monthly stock picks

- In-depth research reports, videos, and podcasts

- Quant Ratings with five-year projections

- Customizable investment strategies

The chief monthly perk is receiving five new stock picks. From there, you can choose to invest in those stocks or not. With that many recommendations, you most likely won’t invest in them all every month, but it’s easier to pick those fitting your investing goals.

Before you start looking for overnight returns, keep in mind that this service is designed for long-term investors. The stock analysts highlight stocks with an outsized possibility of beating the stock market if you hold your share for the next three to five years.

However, as a long-time Motley Fool subscriber, I can personally attest that not every monthly pick is a winner. It can also be heard to realize positive gains when the broad market is bearish.

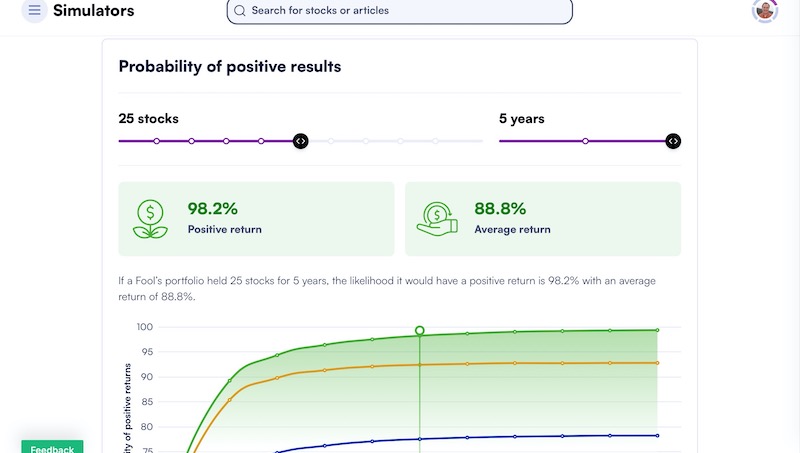

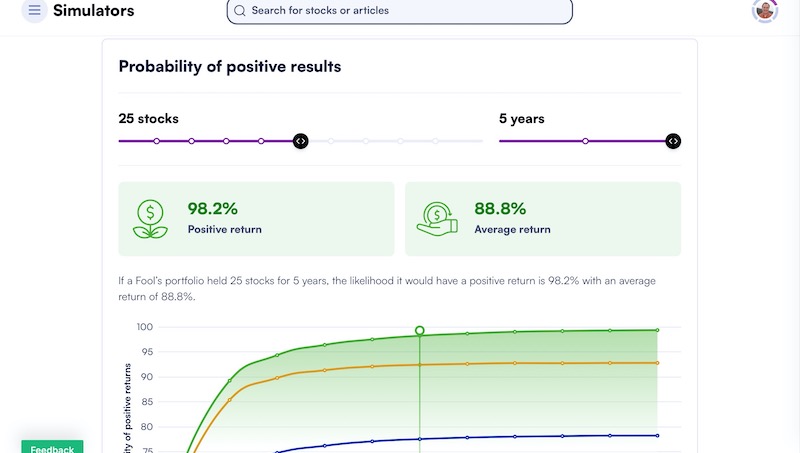

The platform suggests that you hold at least 25 of the stock picks for at least five years to build wealth for the long term. I think this is a good suggestion as you diversify your portfolio, but you need a sizable portfolio to invest regularly and justify the $499 annual fee.

How Much Does Motley Fool Epic Cost?

Working with Motley Fool Epic isn’t free. Luckily, it is more affordable than you might expect.

New and existing members can sign up for $499 per year. This is relatively expensive. Thankfully, you have 30 days to request a full refund if the service isn’t a good fit.

Epic costs more than entry-level stock newsletters, which usually cost $199, such as Motley Fool Stock Advisor. But this is a mid-tier product that provides advanced research and five monthly picks instead of two.

In my opinion, it’s competitively priced for the quantity and diversity of analysis.

Key Features

If you want to build a profitable portfolio of individual stocks with considerable growth potential, without sinking hours into it, then Motley Fool Epic should be a top consideration.

At a relatively affordable price point, you’ll unlock the following features.

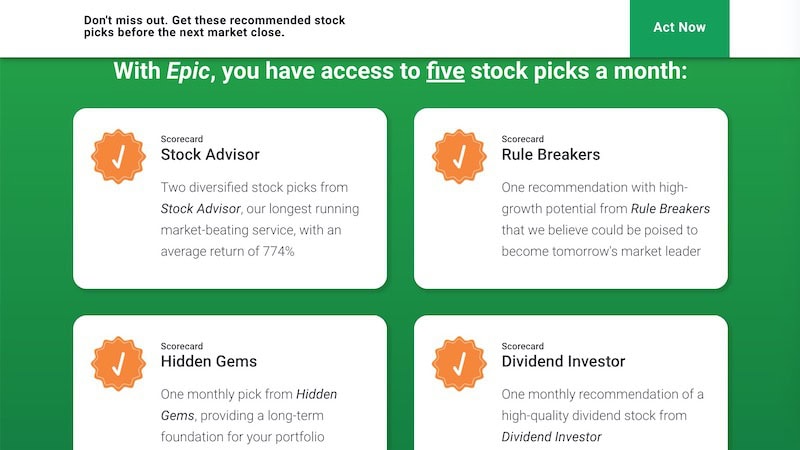

Five Stock Picks Per Month

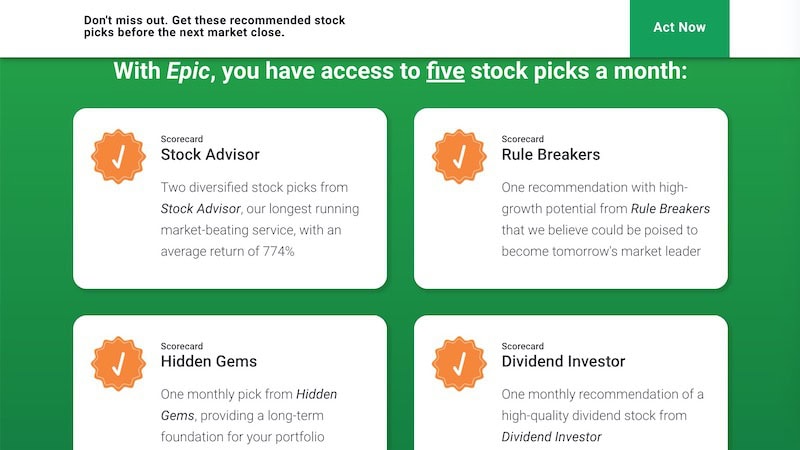

The main draw of this service is receiving five stock picks each month ranging from aggressive growth to dividends.

- Stock Advisor: Two picks from the entry-level platform appealing to most investors.

- Rule Breakers: One pick focusing on high-growth potential but more volatility than Stock Advisor.

- Hidden Gems: One long-term investing idea.

- Dividend Investor: One high-quality dividend stock per month.

With five new stock picks each month, you can build a robust portfolio within a year as you get 60 new recommendations. You will also receive monthly updates featuring the best open investments from each of the four model portfolios to fill in the gaps.

Easy-to-Implement Guidance

As the month progresses, you will receive the latest stock picks and updated stock rankings. It can only take a few minutes to implement the guidance in your portfolio as you read the potential rewards and risks. You will also find a link to read the latest research report.

Essentially, you’ll need to decide whether or not you want to move forward with that particular stock purchase. If you do, then it is just a matter of logging into your brokerage account to execute a buy order.

Long-Term Outlook for Individual Stocks

This service is designed for investors looking to build a portfolio for the long term. The Motley Fool believes that “the best chance to succeed in the stock market is to buy at least 25 stocks and hold them for at least five years.”

You can simulate potential investment returns with a portfolio simulator. The proprietary quant ratings also project the maximum drawdown and profit potential over the next five years.

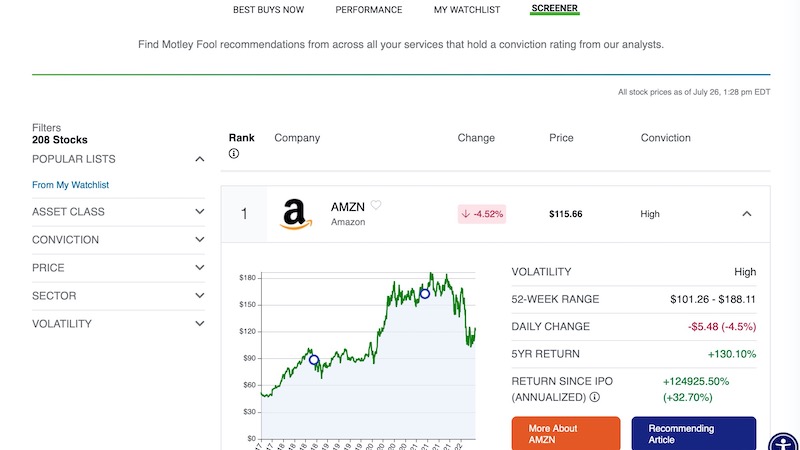

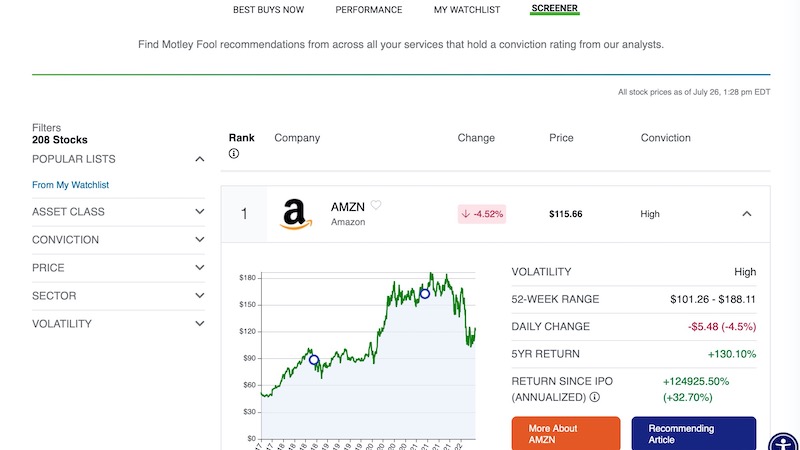

Stock Screener

The members-only stock screener lets you quickly identify potential investments from the open recommendations across the Epic portfolio.

It can be challenging to invest in every monthly pick and the screener can help find stocks fitting your criteria to maintain a diversified portfolio. For example, you can customize them by risk rating or other factors.

Rule Breakers Reviews

Here are some reviews from people who have used the platform:

“Motley Fool’s changed my life in this main respect: I’m financially independent today. I didn’t think that would be possible until maybe my mid or late 60s. I have the ability to make choices and quality-of-life decisions now that I would never be able to make before.” – Mark T

“I use the Fool to do the things that I don’t have time to do. If you have a busy life and want to invest in the market, this is one of the best vehicles to support you in doing that.” – Bob A

Is Motley Fool Epic Worth It?

Joining Motley Fool Epic can be worth it if you’re an aggressive investor with a long-term investment horizon. Most of the monthly stock picks look for growing companies that most investors don’t know about and it can take several years of volatility to realize a profit.

Simultaneously, the dividend and Hidden Gems picks can be more cautious to help balance your portfolio allocation. It’s possible to have Epic be your only investment newsletter subscription for a flat $499 annual fee.

Motley Fool Epic Alternatives

If you are looking for help with researching investments at a more affordable price, Epic is not your only option. Here are a few other options worth considering.

Motley Fool Stock Advisor

The Motley Fool Stock Advisor is a premium newsletter service that also offers two new stock picks each month. This service is a bit cheaper as the first year for new members costs $99^, and the second year costs $199.

You can also take advantage of a 30-day membership-fee back guarantee.

^Based on $199/year list price. Introductory promotion of $99 for the first year is for new members only

Seeking Alpha

If you want to stay away from The Motley Fool altogether, consider trying Seeking Alpha. You receive access to investment research and premium ratings for most stocks, ETFs, and mutual funds. You’re not restricted to a model portfolio and the annual cost is $299 after a one-month paid trial.

Related article: Seeking Alpha Vs Motley Fool: Which Is Better?

Stock Rover

Stock Rover can be another great choice if you are looking for self-directed research tools helping long-term investors. The service offers useful tools like a stock screener, portfolio tracking and comparison tools.

It costs anywhere from $79.99 to $279.99 annually depending on the subscription you select. Customers can try the service for free for 14 days.

Another option if you’d like to avoid The Motley Fool services is Zacks Premium. This investment research service is the cheapest option offered by Zacks at $249 annually after a 30-day free trial. Read research reports for most stocks and funds, plus a long-term model portfolio.

FAQ

If you are still on the fence about using Motley Fool Epic, these frequently asked questions might be able to help you make a decision.

The annual fee of $499 for Motley Fool Epic could be worth it, but it depends on your unique situation. If you are looking to receive regular stock picks to help you grow your portfolio for the long term, it could be a great choice.

However, if you are looking for a quick return on your investment, then you may want to look elsewhere.

Yes, The Motley Fool is a legitimate company. You’ll find a variety of services designed to help investors build portfolios that meet their financial goals. It also has a long history of helping investors pick individual stocks.

The Motley Fool offers an online database of support articles to help you. You can also get email support if you have questions about your account.

The service offers a 30-day membership-fee-back guarantee. If you are not happy with the service, you can get a refund of your membership fee as long as you cancel within 30 days.

Summary

Motley Fool Epic presents a great opportunity for investors who are short on time but have the money to invest in aggressive and cautious stocks with long-term growth potential. The five monthly stock picks make it easy to find investment ideas, but you must be comfortable with the $499 annual fee.