Political events have a significant impact on trading economics around the world. From elections and policy changes to wars and trade agreements, political events can cause fluctuations in markets, currencies, and investor confidence. Understanding how these events can affect trading economics is crucial for investors and traders to make informed decisions and manage their risks effectively.

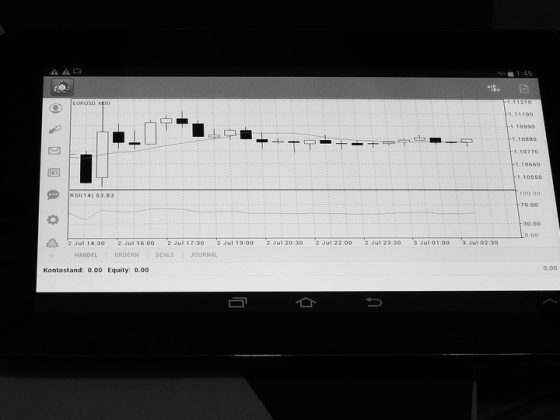

One of the most immediate and direct impacts of political events on trading economics is the influence they have on market sentiment. Political uncertainty can lead to market volatility as investors become cautious and hesitant to make large investment decisions. For example, an unexpected election result or a sudden change in government policy can create uncertainty in the markets, causing stock prices to fluctuate and currency values to change rapidly.

Political events can also affect trading economics through policy changes that impact businesses and industries. For example, changes in trade agreements or tariffs can have a significant impact on companies that rely on international trade. This can lead to changes in production costs, supply chains, and consumer demand, all of which can affect the overall performance of the economy.

Furthermore, political events can influence central bank policies and interest rates, which in turn can affect borrowing costs, consumer spending, and investment decisions. For example, a change in government leadership or a shift in economic policies can lead to changes in interest rates, which can impact the cost of borrowing for businesses and consumers. This can have a ripple effect on the economy, leading to changes in spending, investment, and overall economic growth.

In addition to these direct impacts, political events can also affect trading economics through their impact on investor confidence. A stable political environment can provide investors with certainty and confidence in the markets, leading to increased investment and economic growth. On the other hand, political instability can lead to a lack of confidence and trust in the markets, causing investors to pull out their investments and leading to a downturn in the economy.

One recent example of how political events can impact trading economics is the ongoing trade war between the United States and China. The trade war, which began in 2018, has led to increased tariffs on billions of dollars worth of goods, causing uncertainty in the markets and leading to fluctuations in stock prices and currency values. The trade war has also had a negative impact on businesses and industries that rely on international trade, leading to changes in supply chains and production costs.

Another example is the impact of Brexit on trading economics in the United Kingdom and Europe. The uncertainty surrounding the UK's exit from the European Union has led to volatility in the markets and changes in investor sentiment. The uncertainty surrounding trade agreements and future economic policies has led to fluctuations in currency values and stock prices, affecting businesses and consumers alike.

In conclusion, political events have a significant impact on trading economics around the world. From changes in market sentiment and investor confidence to shifts in central bank policies and interest rates, political events can cause fluctuations in markets, currencies, and economic growth. Understanding how these events can affect trading economics is crucial for investors and traders to make informed decisions and manage their risks effectively.

FAQs:

Q: How can I protect my investments from the impact of political events?

A: Diversifying your portfolio, staying informed about political events, and seeking advice from financial experts can help protect your investments from the impact of political events.

Q: What should I do if there is a sudden change in government policy that affects my investments?

A: Stay informed, monitor the markets, and consider adjusting your investment strategy to account for the changes in government policy.

Q: How can I take advantage of opportunities created by political events?

A: Monitor the markets, stay informed about political events, and be prepared to act quickly to take advantage of opportunities created by political events.