It’s been a while I wanted to talk about one of my favorite company in the world, Gorilla technology (ticker $GRRR – you can’t make this up)! So make yourself comfortable, this is going to be a fun one. And hopefully, you’ll learn a thing or two about this amazing business. So, what is Gorilla Technology and how are they revolutionizing AI security?

What does Gorilla Technology Group do?

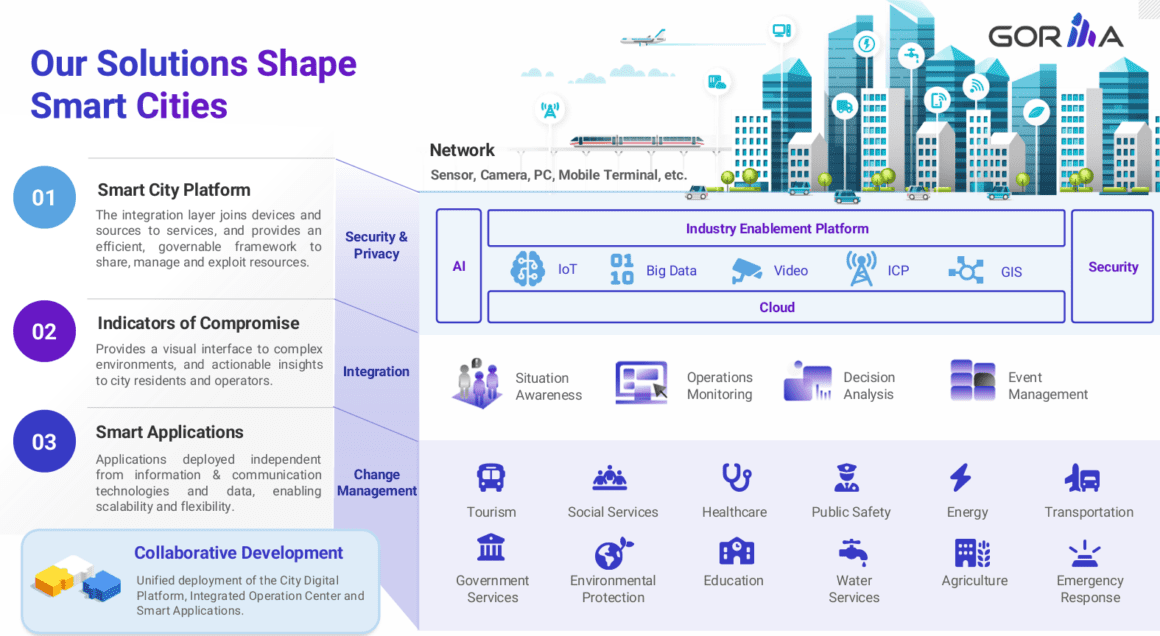

Well, they do a lot of things! But let’s summarize it by saying that they are a leader in AI-driven analytics and cybersecurity solutions. They specialize in big data management, video analytics, and AI technologies for enterprises, public safety, and critical infrastructure.

Ok cool, but what does all this mean anyway? If I had to explain what Gorilla Tech does to my 5 years old, I would say that it is like a super-smart helper that keeps people and places safe. Imagine a big, strong gorilla who watches over everything to make sure nothing bad happens. It uses special computer brains, called AI, to look at cameras, listen to sounds, and find anything that might be wrong. It’s like having a superhero that never gets tired and always keeps an eye out to protect everyone! I hope it’s clearer now!

Ok we understand what they do, now let’s talk about who they are!

Who is Gorilla Technology Group?

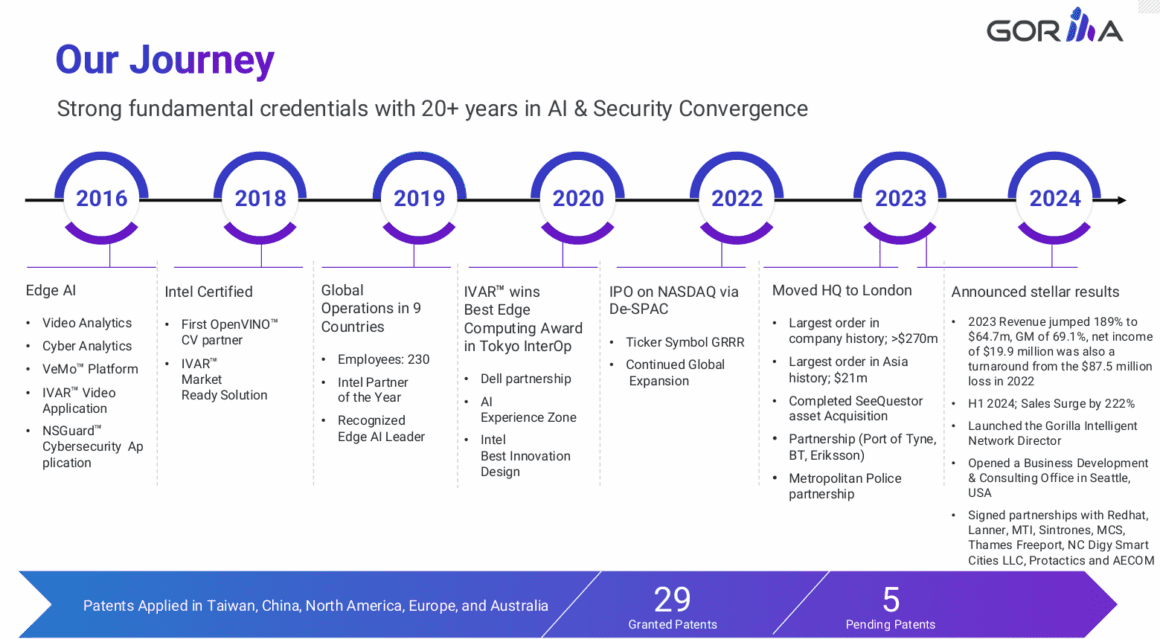

It doesn’t really look like it but this AI company is older than you think! They were founded in 2001 in Taiwan with a focus on video intelligence and analytics. In its early years (2001-2010), the company developed foundational video management systems that laid the groundwork for advanced analytics. Their goal was to bridge the gap between video data and actionable insights for businesses. As you see, they were ahead of the curve since the beginning.

Between 2010 and 2015, Gorilla Technology began expanding its portfolio to include video content analysis solutions tailored to industries such as retail, law enforcement, and smart city applications. This period marked the company’s shift toward incorporating AI and machine learning into its offerings.

Then, in 2016, they introduced what is the cornerstone of their identity today, its Edge AI video analytics and cyber analytics solutions. This was a significant advancement in real time data processing and security threat detection at the time!

Between 2016 and 2022, they continued to innovate and developed numerous partnership with big companies like Intel and Nvidia. Finally, in 2022, they became public as a SPAC (yes I know what you think, a SPAC…) and took the amazing ticker symbol $GRRR. At the day of the De-SPAC (july 14 2022), the share price surged 123% to reach $33.43 (which would be $334.3 today after the 10:1 reverse split they did in 2024).

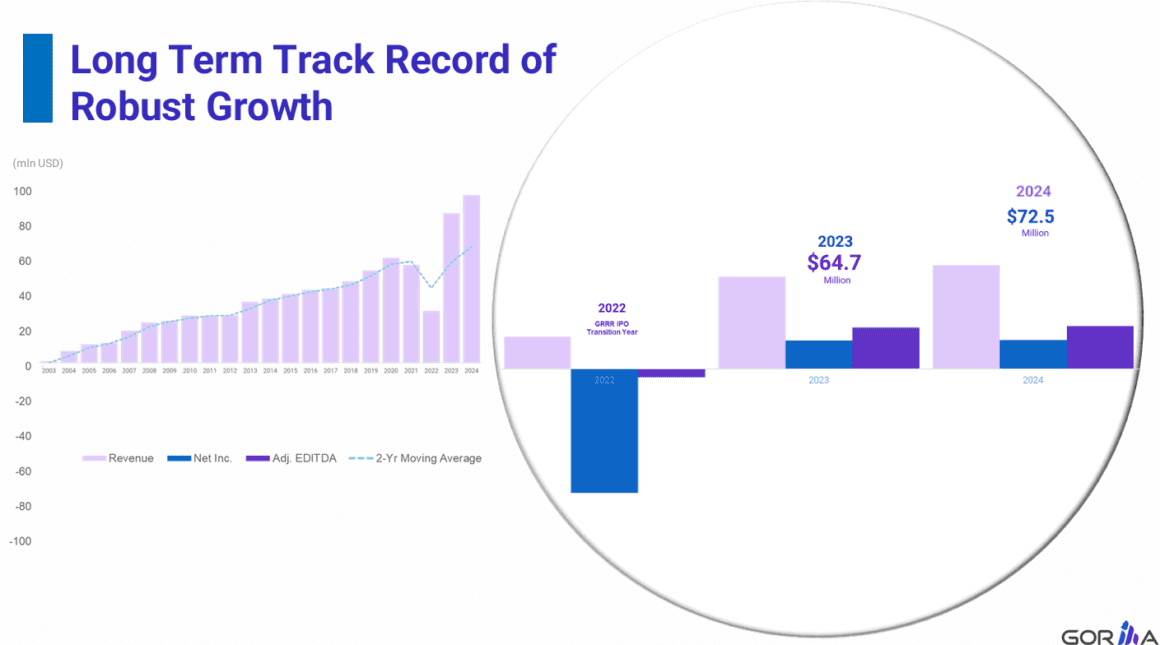

The cash made by becoming public allowed them to bid on largest project all around the world which boosted their revenues. In 2022, they made $22m in revenues, $65m in 2023 and $72m in 2024 (just a projection while we wait for the official results). They also developed many new partneships (Erikson, Redhat, Aecom,…) in the last couple years and managed to reach a pipeline of over $2 billions!

What about their projects and pipeline?

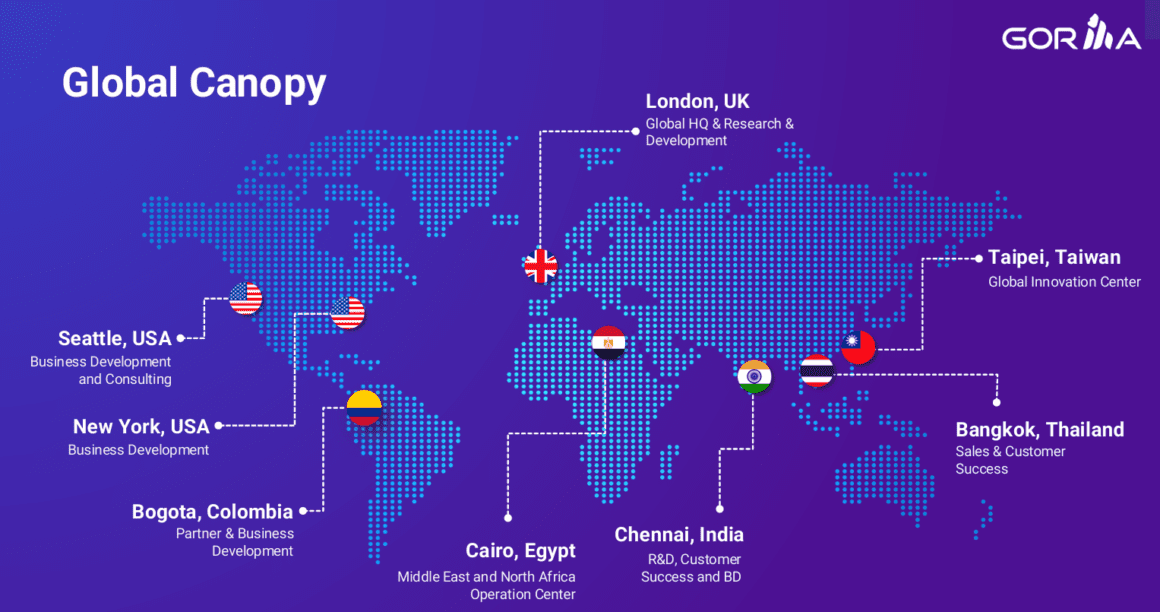

They are basically active all arount the world! They changed their headquarter a couple years back to London, UK, which was a strategic move to get closer to the west. Recently, they even opened a new office in Seattle, USA, which allow them to bid on big american projects (+$70m projects, from the words of the CEO himself)!

Most of their customers are cities, governements or public institutions (schools, public buildings, etc). For example, they signed in december 2024 a contract with the law enforcement sector of Taiwn for a project centred on deploying Gorilla’s AI-powered lawful interception and criminal investigation platform for their institutions. But recently, everybody is talking about an other project that could bring more than $400m+ to Gorilla Tech, which is a groundbreaking smart education project in Southeast Asia. They were shortlisted, then they got the project (CEO confirmed during a podcast), now they just need to work out the paperwork and announce it publicly. This project is a gamechanger for Gorilla and the stock will probably surge once it is public (no financial advice). The pipeline would then also increase to $2.5b+!

It’s nice all of that but who is driving the boat?

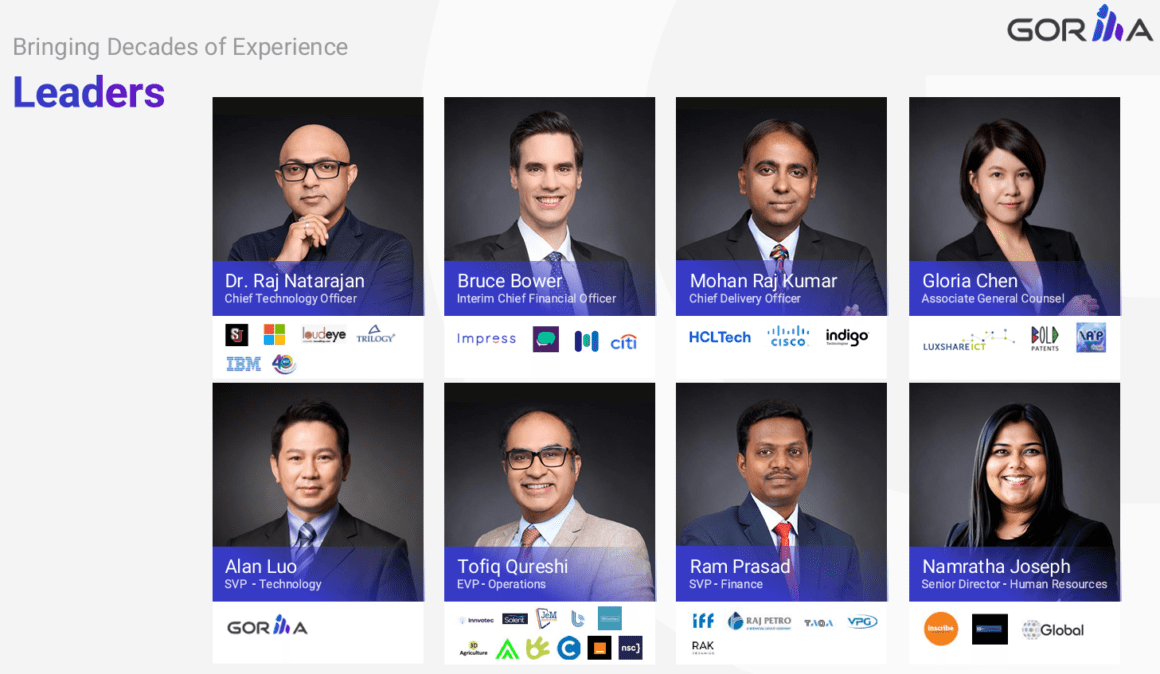

Gorilla Technology is led by a team of experienced executives, with key figures driving the company’s growth and innovation. They come from diverse background and most of them have prior experiences in big public companies (Cisco, Microsoft, Citi, etc).

BUT, the man of the situation is of course the CEO, Jay Chandan! In 2022, he had the hard task to take over the job of the founder of Gorilla Spincer Koh who served as its CEO for over two decades! Jay has extended experience in leading big companies (EXL, Shackleton, Mathern, etc). I have listened to numerous earnings calls and interviews of him and I have to say that I find him very intelligent, transparent about the company and ambitious for its future. And I am a big fan of Guns N’Roses like him, so I take it as a sign 😉

Ok so give me some numbers now!

Gorilla Technology published on january 6 2025 the exercise of warrants that increased the total number of shares to 18’464’651. On january 7 2025, when I write this article, the share price is at $16.98 which gives us market capitalization of around $313m. This is probably the cheapest AI stock you will find in the market today, so keep that in mind!

Their projection for revenues in 2024 are $72m and over $90m for 2025 with a net income of $15m+. At today’s market cap, this would give us a Price/Earnings (P/E) ratio of only 20.8, which is insulting low for a company growing that fast and in AI! Just to laugh, Palantir, a pure AI company, has a P/E ratio at 350….

I personaly think that they will crush their 2025 projections. Why? Because they have big contracts coming their way (remember the $400m+ project in Southeast asia) and they have a lot of cash in hand to execute them (remember the exercise of warrants and also the CFO is talking about selling a building in Taiwan to get even more cash). If I had to make a projection for 2025 revenues and net income I would bet respectively on $120m and $25m. With a net income of $25m, Gorilla P/E ratio would only be of 12!

Conclusion

As a long term stock investor, I study hundreds of companies a year to find the next big one. The stock that can 10x, the stock that you can hold and still sleep well at night. Gorilla Technology Group is one of these stocks. I truly believe they will become a multi-billion company within 5 years if they continue to execute the way they did the last years.

You want to know even more about this company and keep your DD going? Watch this interview of the CEO in december 2024, this will make you bullish for sure!

Did you like the article? Did I forget something? Tell me!

This article is for entertainment only and is not financial advice.

Do you like our deep dives? Check our other ones about High Tide, EOS Energy and Real Brokerage