Let me break down why Auxly is catching my attention in 2025 and beyond. This is: Auxly Cannabis: A Hidden Gem in the Canadian Cannabis Market?

What do they do?

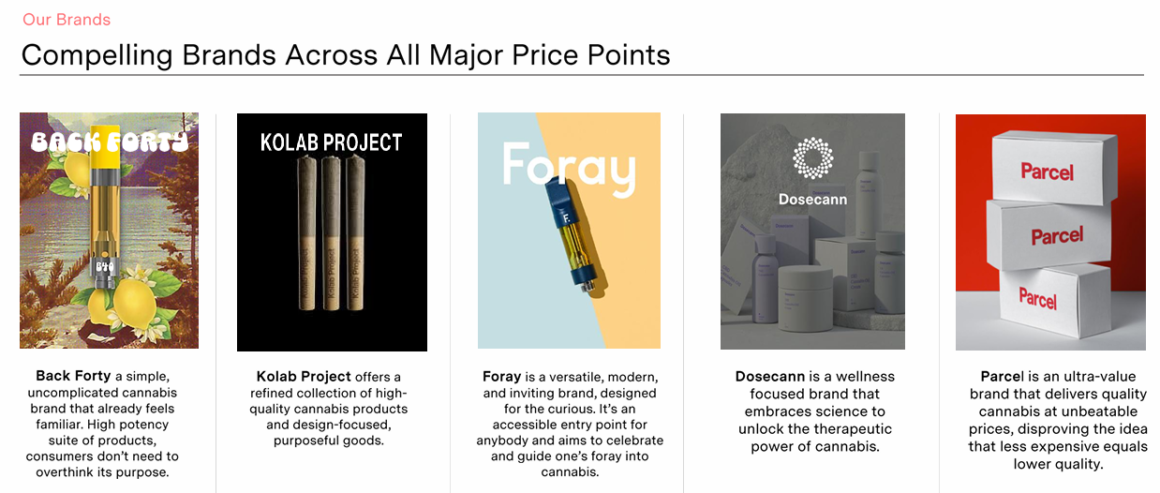

First off, let’s talk about what makes Auxly interesting. Unlike many cannabis players who just pump out dried flower, these folks have their fingers in every pie – we’re talking vapes, pre-rolls, edibles, concentrates, and even topicals. What really caught my eye is their laser focus on automation, especially in pre-rolls, which is becoming a massive segment in Canada.

The numbers

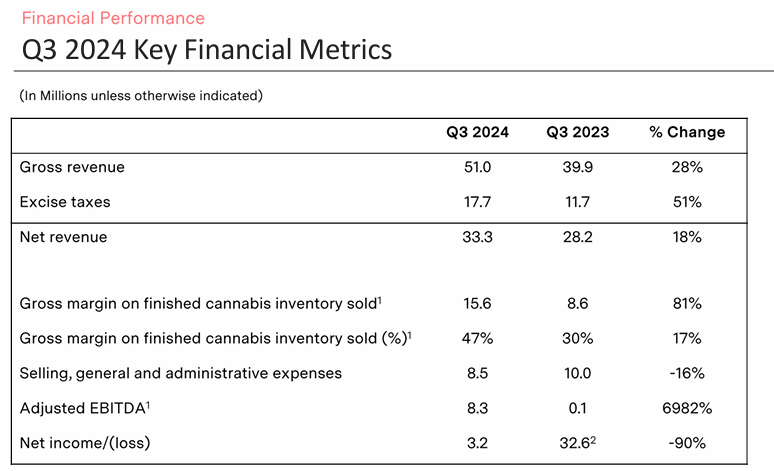

The numbers tell an interesting story. Their Q3 2024 brought in about $51 million in revenue – up nicely from $40 million the year before. But here’s the thing – after paying those pesky excise taxes, they netted around $33 million. Not too shabby, but they’re still dealing with profitability challenges, showing a $21 million loss over nine months (but they were profitable in Q3 2024 with $3.2m!).

Shares structure

Now, let’s talk stock structure – and this is where it gets interesting. They’re sitting at 1.26 billion shares outstanding (yeah, that’s billion with a B). A big chunk of this came from Imperial Brands converting $122 million of debt into equity in early 2024. Speaking of Imperial Brands – these tobacco giants now own about 20% of Auxly, which is actually pretty exciting. Think about it – having a major tobacco player backing you brings serious expertise in branding, distribution, and supply chain management.

Why am I cautiously optimistic about Auxly?

Several reasons:

- Their pre-roll automation game is strong. In an industry where margins are tight, this kind of operational efficiency is gold.

- They’re actually growing revenue while many competitors struggle. Going from $40M to $51M year-over-year in this market? That’s noteworthy.

- That Imperial Brands partnership isn’t just about money – it’s about expertise and potential global expansion down the road.

- Their product mix is smart. They’re not putting all their eggs in one basket, which gives them multiple revenue streams.

But let’s be real about the challenges. Cash position is tight – they’ve got about $19 million in cash but negative working capital of $13 million. They’ll probably need to raise more money at some point, which could mean more dilution for shareholders.

Here’s my take: Auxly isn’t a guaranteed home run, but they’ve got some serious potential if they can execute. Their focus on automation and operational efficiency, combined with strong partnerships and diverse product portfolio, puts them in a good position as the cannabis market matures.

The key will be watching how they manage their cash burn and whether they can turn that revenue growth into actual profits. If they can crack that nut while leveraging their automation advantages, we might be looking at one of the survivors in the Canadian cannabis space.

This was “Auxly Cannabis: A Hidden Gem in the Canadian Cannabis Market?”. Did you like it? Tell us!

Don’t forget that this is not financial advice, do your own dd!