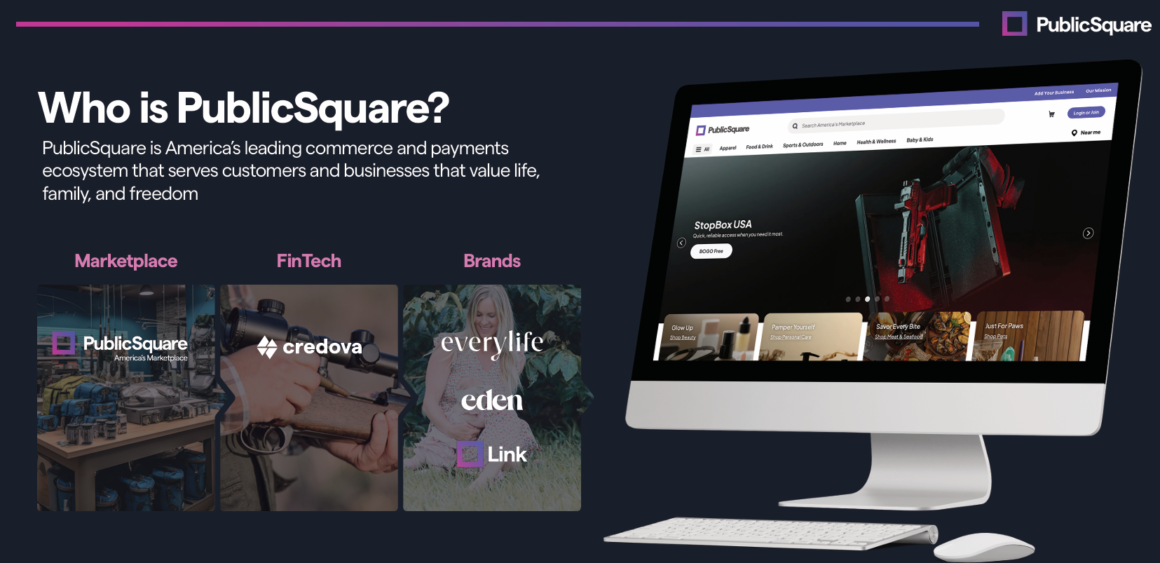

PublicSquare, or PSQ Holdings, is no ordinary online marketplace. It’s designed for people who care about spending their money with businesses that share their values. Founded in 2021 by Michael Seifert, it connects consumers with more than 80,000 small businesses (and growing) that emphasize conservative and pro-life beliefs. At its core, PublicSquare is more than just a platform for shopping—it’s about creating a sense of community. For consumers and small businesses who feel left out by mainstream options, it offers an alternative where values and commerce go hand in hand. So buckle up, this is a deep dive into PublicSquare (PSQ Holdings, ticker symbol PSQH).

How PublicSquare Works

PublicSquare operates in three key ways:

- Marketplace: The online marketplace allows users to shop from businesses that align with their values. Whether it’s clothing, home goods, or baby products, the platform connects like-minded customers and sellers.

- Fintech: With Credova, their offer consumer financing and a payment platform, with a cancel-proof tech-forward platform

- Owned Brands: PublicSquare doesn’t just host businesses—it also sells its own products. A great example is EveryLife, their brand for baby essentials like diapers and wipes, marketed with a strong pro-family message.

The Numbers

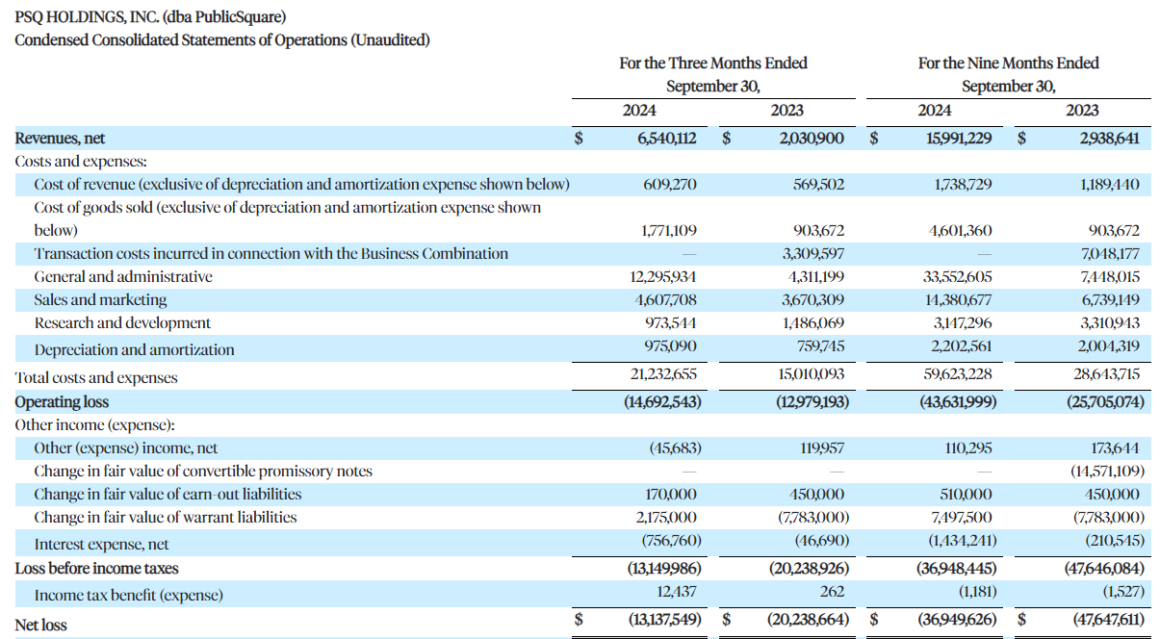

PublicSquare has shown rapid growth, but it’s still a long way from profitability.

- Revenue Growth: In Q3 of 2024, the company brought in $6.54 million in revenue, a 222% increase from the same quarter in 2023. Year-to-date revenue for 2024 hit $16.0 million, a massive improvement from $2.9 million during the same period last year. They’re just getting started, but they’re growing at an impressive pace.

- Margins: Their gross margin remained solid over 60%, showing they’re managing costs well even as they scale.

- Losses: Like many growing companies, PublicSquare isn’t profitable yet. They reported a net loss of $13.14 million for Q3, bringing their total loss for the year to $36.95 million (vs $47.65m the year before). Since their cash position was not great at the end of last quarter, they had to raise cash to keep going (more details later…)

Overall, their growth is impressive, but the path to profitability is still a long way off. Shareholders should be prepared for the possibility of increased debt or additional public offerings in the future to support continued expansion.

Insider Ownership and Leadership Changes

PublicSquare’s leadership team and board of directors bring a lot of credibility to the table.

- Michael Seifert, the company’s founder and CEO, continues to hold a significant stake (around 3.2 million shares), showing his confidence in the company’s vision.

- Donald Trump Jr. and Willie Langston recently joined the board of directors. Trump Jr.’s involvement brings attention to the platform among its target audience and strengthens the company’s brand as a values-driven marketplace. Langston, a veteran in capital markets and investment, brings valuable expertise in financial strategy.

These leadership additions signal that PublicSquare is not just focused on growth but also on establishing itself as a serious player in its niche.

Recent Developments

- $36.2 Million Capital Raise:

In December 2024, PublicSquare completed a $36.2 million registered direct offering of common stock. This move strengthens the company’s balance sheet and gives it more flexibility to invest in growth initiatives. According to the company, this funding will help expand its marketplace, enhance merchant tools, and improve user experience. - Board Appointments:

The appointments of Donald Trump Jr. and Willie Langston to the board highlight the company’s strategic focus on leadership. Trump Jr.’s presence boosts the platform’s visibility among conservative communities, while Langston’s financial background adds a layer of expertise for managing growth and capital.

What’s Next for PublicSquare?

PublicSquare is gearing up for even more growth, with several exciting initiatives in the pipeline:

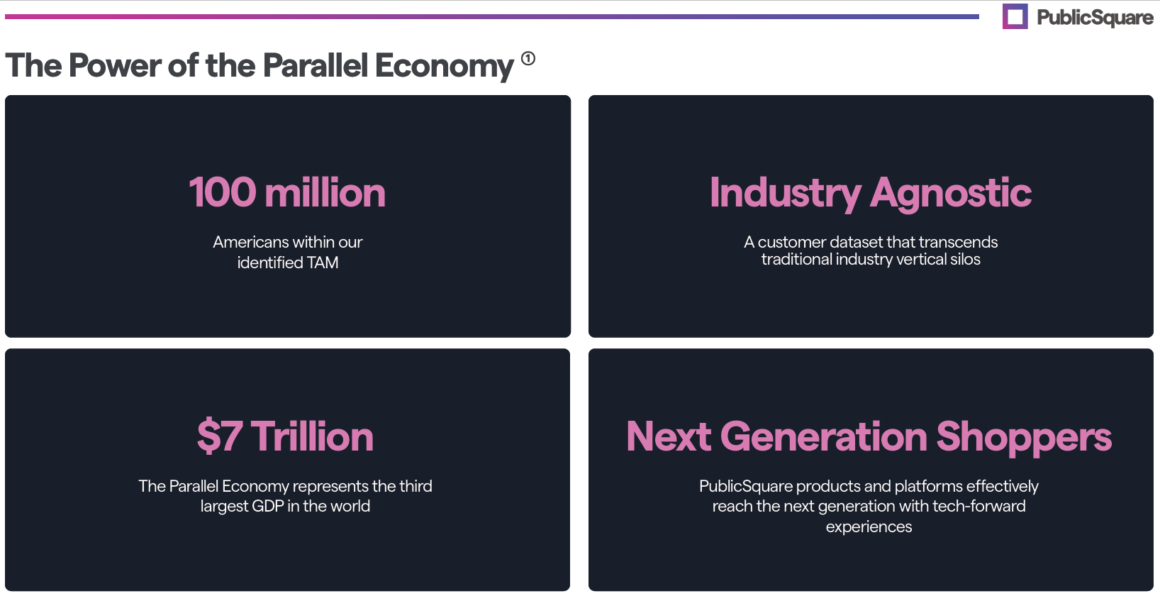

- Expanding Fintech Capabilities: The company is rolling out new payment tools to make transactions easier for merchants and customers. They’ve already signed contracts that could handle over $1 billion in annualized Gross Merchandise Value (GMV).

- Brand Consolidation: To simplify operations and strengthen its identity, PublicSquare is uniting all its offerings under one cohesive brand. This move is expected to reduce costs and make it easier for customers and merchants to connect with the company.

- Merchant Acquisition and Geographic Growth: PublicSquare continues to sign up more businesses (already at over 80k+), particularly small companies that align with its mission. While it’s currently focused on the U.S., international expansion could be a natural next step.

What Makes PublicSquare Different?

In my opinion, PublicSquare stands out from other e-commerce platforms for a few key reasons:

- Values-Driven Approach: It’s one of the only marketplaces where spending aligns directly with personal beliefs, creating a loyal and engaged customer base.

- Champion for Small Businesses: By prioritizing smaller, independent businesses, PublicSquare offers an alternative to platforms that cater primarily to large corporations.

- Community Focus: Beyond shopping, PublicSquare creates a space where like-minded people can connect, strengthening relationships between buyers and sellers.

- Leadership Vision: With Michael Seifert at the helm and recent high-profile board additions, the company is led by people who believe deeply in its mission and have the skills to grow it.

So, Why Be Bullish on PublicSquare?

In conclusion, PublicSquare has significant long-term potential. The company’s rapid revenue growth demonstrates its ability to tap into an under-served market. Its values-driven approach has fostered a loyal and expanding customer base, while the leadership team’s strong ownership in the company shows their deep belief in its success. Plus, the recent $36.2 million capital raise provides the necessary resources to scale quickly, supporting further growth.

While profitability is still on the horizon, PublicSquare’s positioning is definitely a company worth watching. If they continue to expand their user base, broaden their offerings, and manage costs effectively, PublicSquare could carve out a significant space in the e-commerce market.

This was “A Deep Dive into PublicSquare (PSQ Holdings)”. Did you like it? Tell us!

Here are other of our deep dives: High Tide, Gorilla Technology, EOS Energy, the Real Brokerage and Clover Health