On january 17th 2025, Canoo Inc., an electric vehicle (EV) startup (ticker symbol $GOEV), has filed for Chapter 7 bankruptcy, leading to immediate cessation of its operations. This development carries substantial consequences for various stakeholders of the company. So now that Canoo files for bankruptcy, what’s next for the shareholders?

Understanding Chapter 7 Bankruptcy

Chapter 7 bankruptcy involves the liquidation of a company’s assets to repay creditors. A court-appointed trustee oversees this process, distributing the proceeds from asset sales to creditors based on legal priorities. Shareholders are typically last in line, often receiving little to no compensation (sorry guys!).

Impact on Canoo Shareholders

For Canoo shareholders, the Chapter 7 filing means:

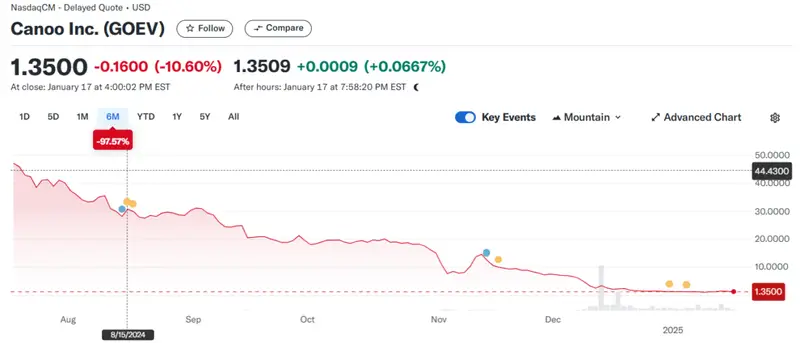

- Stock Valuation: Canoo’s stock value is expected to plummet, reflecting the company’s insolvency. As of the latest trading session, the stock price was $1.35, down 11.92%. When the stock will open again on Tuesday January 21st, the stock will probably go down much further (50%+ down is possible).

- Asset Liquidation: The proceeds from selling Canoo’s assets will primarily go to secured creditors. Given Canoo’s liabilities exceeding its assets, it’s unlikely that shareholders will receive any return on their investments.

- Trading Suspension: The company’s stock may be delisted from stock exchanges, rendering shares illiquid and worthless.

Conclusion

Canoo’s Chapter 7 bankruptcy filing is a significant setback for its shareholders, who are unlikely to recoup their investments. This situation highlights the inherent risks associated with investing in early-stage companies within emerging industries.

This was “Canoo files for bankruptcy – what’s next for the shareholders?” Did you like it? Tell us!

This article is not financial advice, do your own due diligence please!