It’s been a while since I’ve wanted to take a closer look at Eos Energy Enterprises (ticker symbol $EOSE). This company has been all over social media, with investors and clean energy enthusiasts buzzing about its potential. Now seems like the perfect time to dig in and analyze what Eos is all about, why it’s getting so much attention, and whether it could be a game-changer in the energy storage industry. This is EOS Energy Entreprises: leading the charge in clean energy storage, enjoy!

What Does Eos Energy Do?

Eos Energy Enterprises is on a mission to change the way energy is stored and used. Founded in 2008, the company has developed a zinc-based battery technology that offers a safer, more sustainable alternative to traditional lithium-ion systems. Their Znyth™ battery is designed for long-duration energy storage (3 to 12 hours) and is perfect for utilities, renewable energy projects, and other large-scale energy users.

If I had to explain Eos Energy to my 5-year-old, I’d say this:

“Imagine you have a toy that runs on batteries, but those batteries don’t last long and can sometimes get really hot. Eos makes a super safe, long-lasting battery that can power big things like buildings and solar farms. And guess what? Their batteries are made from stuff that’s easy to find and recycle, so it’s better for the planet!”

So now we understand that Eos Energy Enterprises offers innovative energy storage solutions tailored to various needs. For example, their Eos Cube is a modular, containerized system ideal for diverse applications, while the Eos Hangar provides large-scale storage with reduced ancillary costs. The Eos Stack, designed for urban environments, offers compact, reliable indoor energy storage. All solutions leverage Eos’s zinc-powered batteries, which maintain 88% capacity over 20 years without system oversizing, cut equipment costs by up to 30% by eliminating cooling and fire suppression needs, and reduce energy losses with minimal auxiliary power. Additionally, their components are fully recyclable, making end-of-life disposal cost-neutral. Sounds pretty good to me 😉

Recent Developments: Eos in the Spotlight

Eos has been making (a lot of) headlines in the last 2 months, with several exciting updates:

- Factory 2.0 location search

Eos is currently searching for a location to build a new manufacturing facility, called Factory 2.0. This would increase their production capacity significantly. This facility will help the company meet the growing demand for its batteries while supporting U.S. manufacturing and creating hundreds of jobs. - DOE Loan and $68.3 Million Draw

The company secured a $303.5 million loan guarantee from the Department of Energy (DOE) under its Title XVII Clean Energy Loan Program. Eos has already drawn $68.3 million from this loan, giving it the financial muscle to scale operations and accelerate growth. - 400 MWh Energy Storage Order

Eos received a major contract to deliver 400 MWh of energy storage to a leading renewable energy developer (International Electric Power). This is one of the largest orders in the company’s history and a strong vote of confidence in its technology. - FlexGen Partnership

Eos partnered with FlexGen, an energy storage software and solutions leader, to expand the adoption of its zinc-powered batteries. This collaboration aims to deploy Eos’s technology more broadly, helping customers improve grid reliability and lower carbon emissions. - Growing Pipeline

Eos’s pipeline of potential projects continues to grow, with a backlog exceeding $500 million and a pipeline $14.2 billion (as of november 5th, according to utilitydive). These figures highlight the (very) strong demand for its innovative energy storage solutions.

Financial Performance: A Mixed Picture

On January 16th, 2025, Eos Energy Enterprises had revised its 2024 revenue guidance to $15 million, driven by increased customer deliveries in the fourth quarter. This improvement is attributed to the stabilization of supply chain bottlenecks related to the new Z3 Inline Energy Cube deliveries, achieved through enhanced supplier performance and additional capacity.

Looking ahead, the company projects 2025 revenue between $150 million and $190 million (yes, we are talking about a 10X minimum on revenues growth!). This anticipated growth is expected to result from increased production volume on the first state-of-the-art manufacturing line and a strengthened supply chain. Over the past six months, Eos has been ramping up its manufacturing line while securing critical financing and adding to its customer orders backlog.

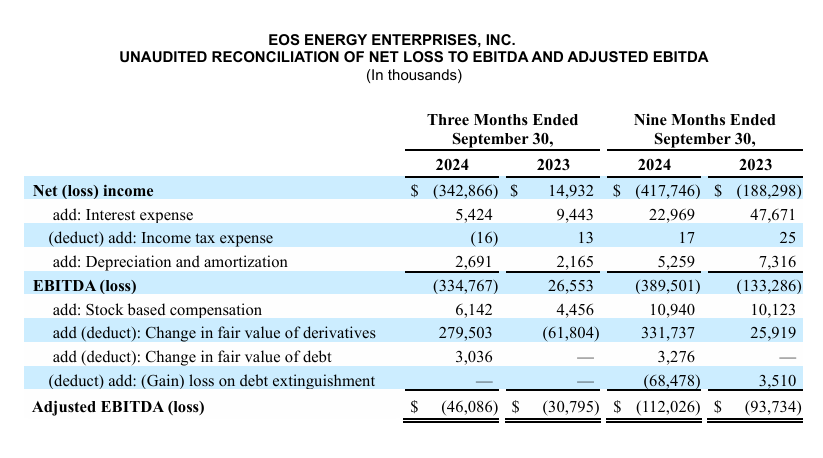

As a fast-growing company, Eos Energy is not yet profitable and is burning through cash. As mentioned earlier, they rely on loans to fund their growth until they can reach profitability. This reliance on external funding is an important risk factor to consider during your due diligence process. Moreover, achieving profitability will depend on the successful execution of their growth strategy, ongoing operational improvements, and scaling production. So keep that in mind please!

Market Position and Analyst Coverage

With a market cap of $1.32 billion (as of january 17th, 2025), Eos sits in the small-cap category, competing with other energy storage companies like:

- Fluence Energy (FLNC): $2.69 billion market cap.

- Stem Inc. (STEM): $500 million market cap.

- Enphase Energy (ENPH): $64.46 billion market cap.

Analysts are generally optimistic about Eos. The average price target is $5.42, with highs reaching $7.00. Many rate the stock as a “Strong Buy,” seeing significant growth potential in the company’s unique technology.

Leadership: The Man at the Helm

Eos is led by CEO Joe Mastrangelo, who joined in 2019. With nearly 30 years of energy industry experience, Mastrangelo has held top roles at General Electric, including CEO of GE’s Power Conversion business. His vision and expertise are central to Eos’s success.

Mastrangelo also owns shares in Eos, aligning his goals with those of other investors. Insider ownership stands at about 7%, showing strong commitment from leadership.

The Road Ahead

As we saw, Eos plans to grow revenue tenfold in 2025, expand its manufacturing footprint, and fulfill its growing order backlog. With innovative technology, strong financial backing, and an experienced team, Eos is poised to lead the clean energy revolution.

For investors, Eos Energy Enterprises represents an exciting opportunity in the renewable energy space. While it’s still in its early stages, the company’s progress and ambitious plans make it one to watch in the rapidly evolving energy storage market.

Personally, I’m really impressed with what Eos Energy is doing and the direction the company is heading. However, I plan to wait a bit before jumping in and purchasing shares. If they do manage to 10x their revenues in 2025, it will confirm that the demand is there. At that point, I’ll reassess the situation and might consider buying shares.

This was “EOS Energy Entreprises: Leading the Charge in Clean Energy Storage”. Did you like it? Tell us!

Do you like our deep dives? Check our other ones about High Tide, Gorilla Technology and Real Brokerage

Just a reminder guys, this is not financial advice, please do your own research before buying or selling a stock!