Alright, everyone, today we’re taking a different approach with our analysis. Instead of diving into a company, we’re going to focus on an investor relations team: RedChip.com. This team handles the communications between Gorilla Technology Group ($GRRR) and its shareholders. From what I’ve uncovered, there are several red flags and, to say the least, it raises some concerns about their practices and messaging. In fact, I believe there are valid reasons for Gorilla Technology Group to consider parting ways with them in order to avoid potential issues that could negatively affect both the stock and the company’s reputation.

Just a quick note before we dive in, so there is no confusion. I’m bullish on Gorilla Technology Group (you can read my article “How Gorilla Technology is revolutionizing AI security”). My goal here isn’t to tear down the company but rather to highlight areas where improvements can be made. By pointing out these potential issues, I hope to help the company continue to succeed in the long term. That’s it—this is all about constructive feedback to ensure their continued growth and success!

So grab a coffee and settle in. This is my take on why I think Gorilla Technology Group might want to reconsider their external IR team…

Who is Redchip.com and what do they do for Gorilla?

According to RedChip.com, they proudly position themselves as the “world leader in investor relations, financial media, and research for microcap and small-cap stocks.” Founded in 1992 and headquartered in Florida, their business model is straightforward. They offer services such as research reports, newsletters, and various media content tailored to investors seeking growth opportunities in emerging companies. They also host investment conferences and webinars where companies and analysts present information to potential investors. Additionally, RedChip manages investor relations for companies, which is the role they currently play for Gorilla Technology Group.

RedChip also handles shareholder communications by answering questions on behalf of the company, and they host webinars every few months where investors can ask questions directly to the Gorilla Technology Group board (see the video below with the interview of the CFO of Gorilla by Redchip).

So, how do they get paid?

So far, this all sounds good, right? But here’s where things take a turn. How does RedChip get paid for these services? This is where I personally see a potential issue: RedChip is compensated by the companies they work with to promote their stocks. These companies often pay for RedChip’s research, reports, or appearances at their events.

This raises concerns in my opinion about the objectivity of their research. When a company is paying for positive coverage, it’s hard to believe that the research is entirely impartial. With this compensation structure, RedChip may have less incentive to report negative news or offer a balanced view. Instead, they might focus more on promoting the positives while downplaying the negatives. Again, this is just how I interpret the situation.

What shareholders really need is an investor relations team that provides a complete, honest picture of a company—both the good and the bad—not one that might focus more on the positives while overlooking potential risks. This model could create a conflict of interest, and it’s a major reason why investors should be cautious when dealing with RedChip, in my opinion.

One real-life example

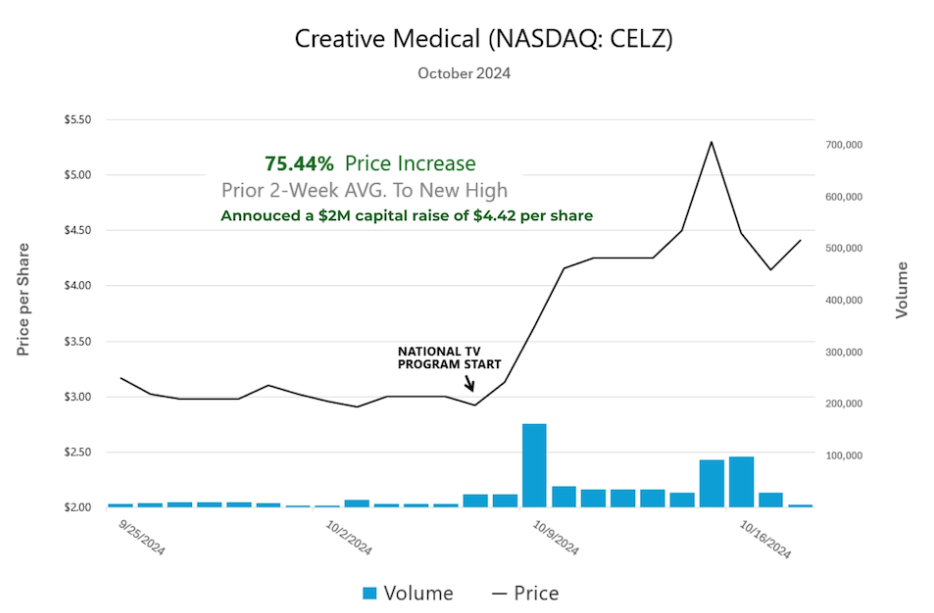

Just for context, let’s take a look at a real-life example of what RedChip’s promotional efforts can do for one of their clients, Creative Medical Technology ($CELZ). In the image below, we can see when RedChip’s national TV campaign began. As expected, the stock saw a massive spike—its share price shot up from $2.90 to $5.30 in just a week, and the trading volume surged. Looks great, right?

Well, not so fast. If you look at what happened next (because they don’t show it on their website…), you’ll notice the stock price quickly plummeted back down to its previous levels and is now trading at just $2.20—lower than where it started before the campaign even began…

The stock got a quick boost thanks to the promotional campaign, only to have the price drop once the hype died down. This pattern is all too familiar in the world of micro-cap stocks, and it raises questions about the long-term value and sustainability of such promotional efforts. It’s an example of why investors need to be cautious when a company is heavily promoted without solid fundamentals backing the growth. Not saying this is the case for Gorilla, but this pattern is worth considering.

Public perception and stock volatility

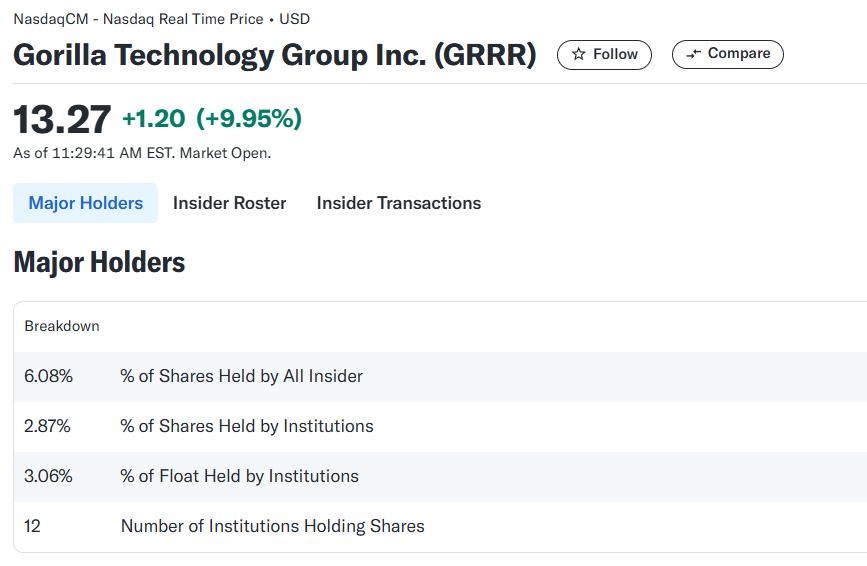

Let’s move on to my second concern. With RedChip’s communications strategy, it’s clear that it can be very effective in appealing to retail investors—people who might be easily swayed by constant positivity about a company. Since most of RedChip’s clients are small or micro-cap stocks, the investor bases they build are predominantly retail investors. This can lead to significant stock volatility, as we saw with Creative Medical Technology, or, more recently, with Gorilla Technology Group, which saw its stock jump from $5 to $25 and is now trading at $13 (as of January 14, 2025).

So, what’s the problem here? Well, if Gorilla Technology Group ever wants to transition into a multi-billion-dollar company, they will need to significantly increase their institutional investor base. Right now, only 3% of their shareholders are institutional investors. In reality, for a company of this scale to achieve long-term success and stability, at least 50% of their shares should be held by institutional investors.

Why is this important?

Institutional investors bring more stability to the stock price—they don’t buy and sell on a whim like retail investors often do. They are also a key factor in establishing the credibility of a company. However, as long as Gorilla continues to use RedChip as their investor relations and communication manager, they may struggle to gain the trust of institutional investors. Why? Because institutional investors are sophisticated. They understand how the market works, they know how to evaluate a company, and they expect transparency and balance in communications. Without institutional support, the stock will continue to be at the mercy of retail investors, with all the volatility and risks that come with it.

Availability and integrity

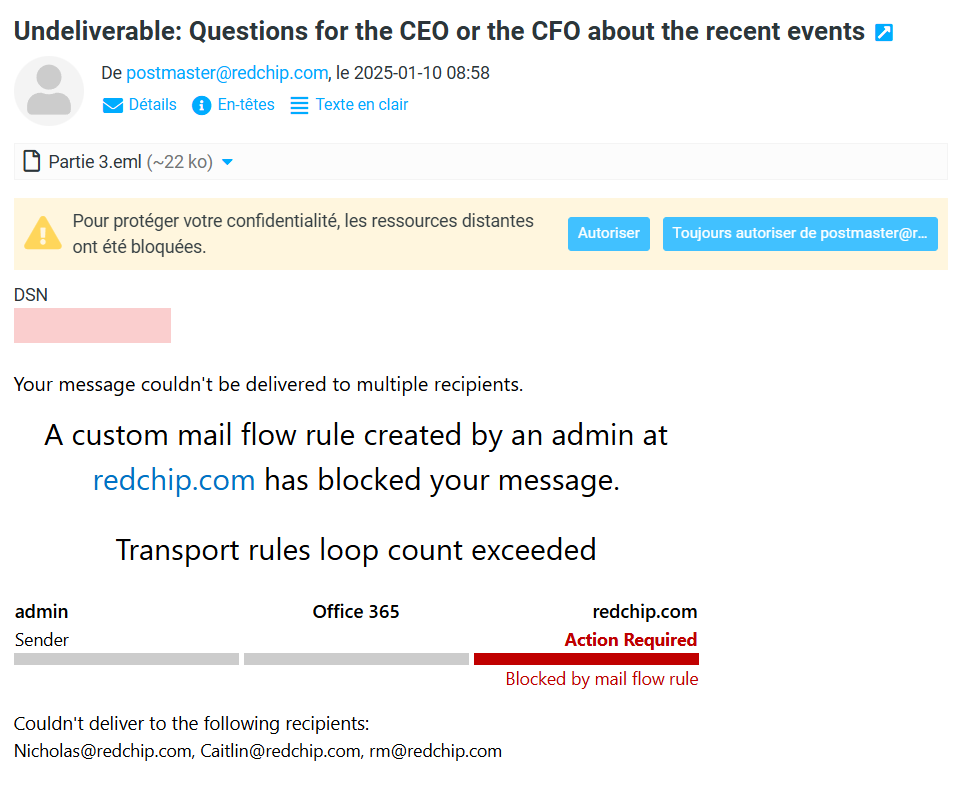

Our final concern is straightforward but incredibly important. Last week, Gorilla Technology Group announced the exercise of warrants, which caused dilution for shareholders. As a result, the stock took a huge hit, plummeting 60% in just a week. Understandably, many shareholders tried to reach out to the IR team at RedChip.com via email to get more clarity on the situation.

Here’s where it gets problematic: Gorilla Technology Group is paying for RedChip to manage their investor relations. But when shareholders tried to contact them, the email address for RedChip’s IR team was not working properly. This issue wasn’t isolated—many other investors reported the same problem. In my experience, I’ve never encountered an IR team that doesn’t respond to shareholder inquiries, especially in a situation like this where people are desperate for answers.

What’s even more concerning is that a week later, the issue still hasn’t been fixed. This raises questions about the professionalism and responsiveness of RedChip’s team, and it doesn’t reflect well on Gorilla Technology Group either.

But wait—there’s more. After you see the image below, I’ve got a surprise that makes this situation even worse. Keep reading.

Take a look at this error message. At first glance, it seems like the IR team has never received your email, and that you’ll never get a response to your questions. That’s exactly what I thought too. But here’s where it gets interesting: My email wasn’t just a complaint about the company. It was a constructive message with a list of questions directed to the CEO.

The surprising response

And surprisingly, just a few minutes after I sent it, I received a response from the IR team! This quick turnaround makes you wonder—why was this email treated with such urgency when others were being ignored? It raises further questions about the professionalism and transparency of the entire communication process.

By the way, this is just my personal experience and not a general indictment of their practices.

Conclusion

As I mentioned, I believe that Gorilla has the potential to become a multi-billion-dollar company in the future. It’s because I care about the company’s success that I’m writing this article today. However, I firmly believe that being associated with a firm like RedChip could affect Gorilla’s reputation in ways that may hinder its growth. Given the company’s rapid expansion, it might be wise for Gorilla to hire an internal Investor Relations team, rather than relying on an external firm for this crucial role.

By doing so, Gorilla could significantly enhance its credibility, especially with institutional investors, and better control its messaging. This would help strengthen the company’s narrative and instill more confidence as it continues to grow and evolve. The Gorilla story is far from over, and taking this step would be a smart move for the future!

This was “Why Gorilla Technology Group should fire their IR Team”. Did you like it? Tell us!