KULR Technology Group ($KULR, yes it’s a cool ticker symbol) has been generating significant buzz on platforms like Reddit, StockTwits, and X recently, thanks to its stock price soaring over 550% in less than two months, reaching an all-time high of $4.80 on December 26, 2024. This surge has certainly cultivated a type of “cult following”. And as a result, this article might face some backlash (don’t be too hard on me). I’ve done my best to conduct thorough due diligence, but after my analysis, I believe the stock is currently overvalued. Here are 3 reasons not to buy Kulr Technology stock in 2025.

1.The fundamentals

The main reason I wouldn’t touch Kulr stock is its massive overvaluation, even after the share price has plummeted over 50% in the last month. As of January 15, 2025, with the stock trading around $2.30, Kulr’s Price-to-Sales (P/S) ratio sits at a staggering 38. For context, other high-growth stocks we’ve analyzed on this site—such as Gorilla Technology Group and The Real Brokerage—both of which are seeing double-digit revenue growth—currently have P/S ratios between 1 and 3!

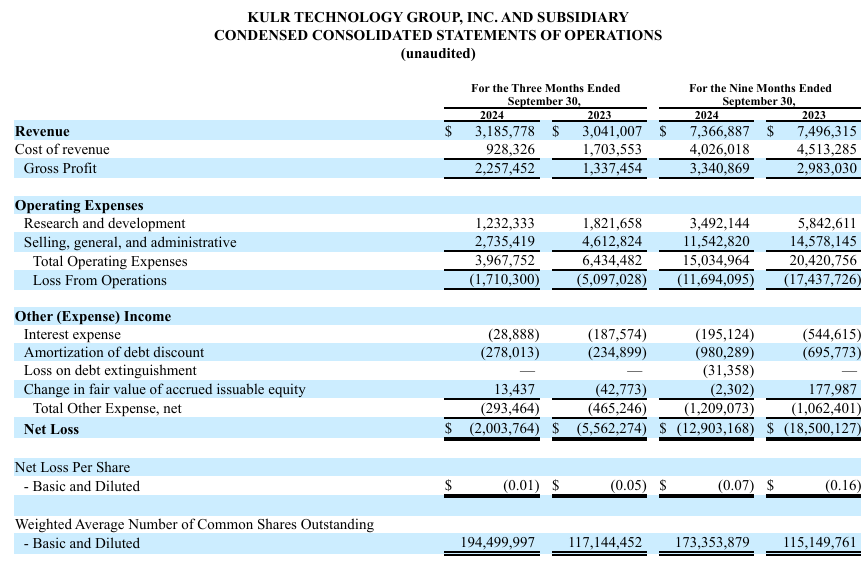

Sure, the P/S ratio might not be the best measure for Kulr, so let’s look at the Price-to-Earnings (P/E) ratio. But that’s not much better, because Kulr isn’t profitable. In fact, in its most recent quarterly report (Q3 2024), the company posted just $3.19 million in revenue (a mere 5% year-over-year increase) and still managed to lose $2 million. But it gets worse. For the first nine months of 2024, Kulr generated only $7.4 million in revenue—a decrease compared to last year—and racked up a hefty $12.9 million loss. This is a serious red flag.

Even if Kulr promised the most remarkable growth imaginable, I still wouldn’t touch this stock. The company’s survival will likely depend on taking on more debt and diluting shareholders through additional public offerings. Consider yourself warned!

2.Their CEO

The CEO of Kulr Technology Group Inc. is Michael Mo. He is also the co-founder of the company. Michael Mo seems to have a knack for riding the waves of hype, but I question whether he’s the right person to lead the company as CEO. Perhaps a marketing role would suit him better…

A prime example of his marketing savvy is Kulr’s recent $43 million investment in Bitcoin, made at a price of $98k per coin. With Bitcoin making headlines and companies like MicroStrategy leading the charge, it’s clearly a trend that investors are currently excited about. But with Kulr only holding $900k (!) in cash as of September 30, 2024, the big question is: How did they fund this massive Bitcoin purchase? The answer, unsurprisingly, is by heavily diluting shareholders through an additional $50 million public offering (details here).

This move, along with a consistent stream of “positive” news releases, seems more like an effort to keep up appearances than a real strategy for sustainable growth. Kulr’s marketing team knows how to generate buzz, but whether this translates to long-term value for shareholders remains to be seen.

3.Their products

Let’s take a closer look at Kulr Technology’s products. The company specializes in thermal management solutions, focusing primarily on lithium-ion batteries and electronic systems. Their flagship offering is a high-performance thermal interface material designed to efficiently manage and dissipate heat in electronic devices. This is especially important in industries like aerospace, automotive, and consumer electronics, where overheating can cause significant performance issues or even catastrophic failures.

In addition to thermal management, Kulr also provides battery safety solutions, aimed at preventing thermal runaway in lithium-ion batteries—a critical concern as batteries continue to power electric vehicles, portable electronics, and energy storage systems.

However, despite operating in a high-demand space, Kulr faces significant challenges when it comes to competitive advantages. First, the thermal management and battery safety market is highly competitive, with numerous established players, many of which have more robust product offerings, deeper industry relationships, and stronger financial resources. Kulr’s products, while effective, are not fundamentally unique—many competitors offer similar solutions with established track records.

Additionally, Kulr is a small player in a market dominated by larger, more experienced companies. Its ability to scale its technology to meet the demands of major industries, especially considering its financial struggles and lack of profitability, raises serious concerns. Without a clear differentiator or exclusive technology, Kulr risks getting lost in the noise of larger, better-funded competitors who can outspend and out-innovate them.

While Kulr’s technology may meet a market need, it lacks the sustainable competitive advantage that would enable it to dominate its niche. Without major breakthroughs or a unique value proposition that sets it apart from competitors, Kulr faces an uphill battle in a crowded and rapidly evolving industry.

Conclusion

If I want to sleep soundly at night, I would never touch this company. Hype is driving this company, not fundamentals. While their products may serve a need in the market, the company’s financial struggles, lack of profitability, and absence of a real competitive edge make it too risky for my liking. The only thing I can genuinely appreciate about them is their ticker symbol—$KULR. Beyond that, there’s little to get excited about.

This was 3 reasons not to buy Kulr Technology in 2025. Did you like it? Tell us!

My article is for entertainment and IS NOT FINANCIAL ADVICE.