Today, we’re diving into a fascinating company that’s shaking up the traditional real estate industry. Despite its innovative approach and attractive valuation, this publicly traded company remains under the radar for many investors. Meet The Real Brokerage Inc.—let’s have a deep dive guys!

The Story of The Real Brokerage Inc.

Founded in 2014 by Tamir Poleg, The Real Brokerage Inc. (Real) focused since the beginning on transforming the way real estate agents and brokers operate. In 2016, Real launched its first cloud-based platform, enabling agents to manage transactions and communications entirely online. This innovation eliminated the need for costly physical offices, allowing the company to focus on providing superior support and tools to agents.

In 2018, The company began expanding its presence across North America, targeting major metropolitan markets in the United States. Its agent-centric model and competitive commission splits attracted a growing number of real estate professionals. By 2019, Real introduced advanced training programs and technology tools designed to help agents increase productivity and better serve their clients. The company’s reputation as a forward-thinking brokerage began to gain traction.

But…2020 happened! Despite the challenges posed by the COVID pandemic, Real continued to grow, benefiting from its cloud-based model. The company’s technology allowed agents to adapt quickly to remote operations, further solidifying its appeal. This was clearly a significant advantage over more traditional real estate companies, which found themselves burdened with office rents and associated expenses.

2021 marks a big year for the Real Brokerage! They went public, listing on the NASDAQ and TSXV exchanges under the ticker “REAX.” This move provided the company with additional capital to accelerate its growth and expand its market reach. Their share price at this time was around $0.80 for a $300m market cap.

In 2022, the company achieved significant milestones in agent recruitment and transaction volume, breaking into new markets and enhancing its technology platform to provide even greater value to agents and clients. The funds from their IPO enabled them to finance substantial research and development projects, further distinguishing them from their competitors. In 2023, Real launched initiatives to strengthen brand recognition and began attracting institutional investors. The company also introduced new features to its platform, further differentiating itself from competitors. By the end of 2024, they had introduced numerous disruptive technologies aimed at enhancing their agents efficiency (we’ll discuss these later, don’t worry!).

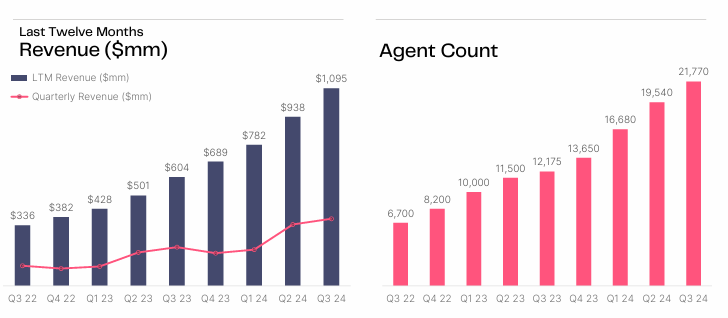

Today, the company boasts over 24,000 agents across America and Canada, growing at an astonishing rate of 1,000 new agents per month. Nothing appears to be halting their expansion, and we might just be witnessing the early stages of The Real Brokerage’s story!

So, What’s to Like About The Real Brokerage?

There’s a lot to admire about this company. I’ve summarized my points with bullet points for your convenience. The list could easily have gone on!

- Disruptive Business Model: Real’s cloud-based brokerage model is a significant departure from the traditional office-centric approach. By reducing overhead costs, the company can offer competitive commission splits, attracting top talent in the industry. Just to tell you how much the company is remote, the CEO works from…Israel!

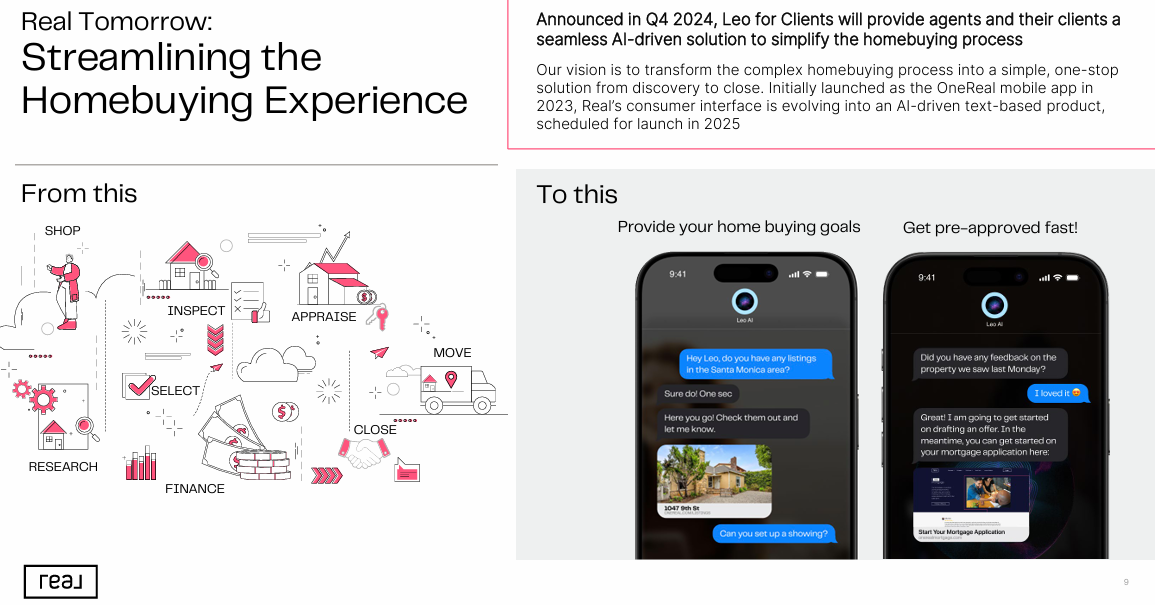

- Focus on Technology: Ok this is the real Moat in my opinion. Real integrates technology into every aspect of its operations, from agent onboarding to transaction management. This tech-driven approach improves efficiency and scalability while enhancing the client experience. To list a few, they already have the following technologies working for them: Leo for clients (AI-driven solution for the communication between clients and agents, Leo CoPilot (and agent command center anticipating each agent’s needs and providing personalized support) and Real Wallet (offering US agents a Real-branded debit card and Canadian agents a business line of credit tied to their revenue and assets, with additional fintech products expected to follow in 2025). All these products are unique in the industry, years ahead of the competition. The feedbacks from their agents are amazing (see an example here).

- Strong Growth Trajectory: The company has shown impressive growth in agent count and transaction volume. Its innovative model has resonated with agents seeking better support and higher earnings. Just one metric to illustrate how fast they are growing: since 2022, they have multiplied the number of their agents by 5! Eventhough they are growing so fast, they are still a relatively small player in the market with only 2% of market share. For me, the best thing about their strong growth trajectory is the fact that they manage to do it in the tough real estate market of the last couple years (high interest rates and demand decreasing).

- Attractive Valuation: Despite its growth, Real’s stock remains undervalued relative to peers, presenting a big opportunity for investors. We will go more into details about their financials later but just to give you a little preview, their revenues reached $914m for the first 9 months of 2024 and their market cap is only $850m (as january 10, 2025).

- Expanding Market Reach: Real has aggressively expanded its operations into the United States and Canada, one of the largest real estate markets globally. Its presence in multiple states positions it well for continued growth. But there is still a lot of room to grow in the next years.

Risks

Before we jump into the financials, I want to talk about the risks for this company. Just remember that no stock investment is without risk and you should only invest money that you can lose. From my research, here are the main risks for The Real Brokerage:

- Intense Competition: Real operates in a crowded space, competing with established players like eXp Realty, Compass, and Redfin. Maintaining differentiation and market share could be challenging. Eventhough I believe their Moat is big enough to surpass their competitors in many sectors and take a good part of their market shares.

- Reliance on Agent Recruitment: The company’s growth is tied to its ability to attract and retain agents. A slowdown in recruitment could impact revenue and profitability. Again, this is a risk they’re aware of, but with such an attractive commission structure and equity participation, their agents have little incentive to depart. Furthermore, initiatives like Real Wallet, where agents can manage their funds directly within the company’s app, significantly strengthen the bond between the company and its agents.

- Economic Sensitivity: The real estate market is highly cyclical and sensitive to interest rate changes and economic downturns. A slowdown in the housing market could impact Real’s transaction volumes. But given that they’ve thrived under these conditions over the last couple of years, I’m certainly not concerned about them in this regard.

- Limited Brand Recognition: Despite its innovative approach, Real’s brand remains less recognizable compared to established competitors, which may limit its appeal to some clients and agents. This is just because we are still at the beginning of their story. Slowly. the brand recognition will expand and the risk will disappear.

Financials and Share Structure

Ok, now we dive into the most interesting part (sorry I am a number nerd), the financials! Let’s start with the most important metrics from their last earnings report for the first 9 months of 2024 (keep in mind it’s only for 9 months and not 12):

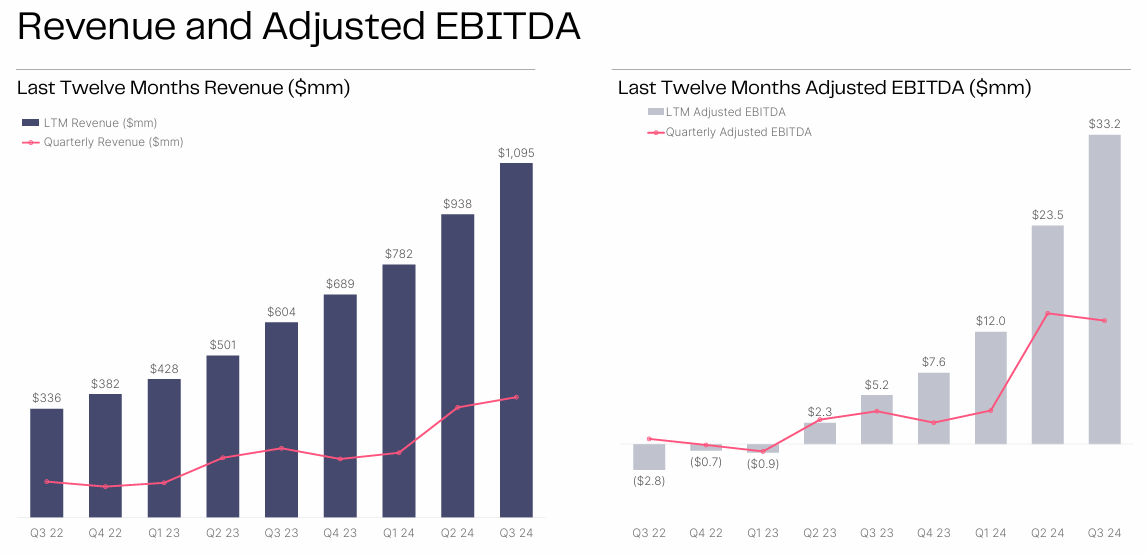

- Total revenues ytd of $914m (vs $508m in 2023, growing 80%)

- The gross profit margin increased slightly from 9.0% in 2023 to 9.2% in 2024. This is because they diversified their revenues with mortgages and titles which have a much higher gross margin. This trend will accelerate in the future, the CEO said!

- The net cash flow provided by operating activities jumped to $44.6m in the first 9 months of 2024 (vs $25.7m in 2023). They reinvested this cash for research and development but also for their share buy-back program (they bought back for $15.1m of their own shares in the Q3 2024 alone!)

- Adjusted Ebitda reached 30.8m in the first 9 months of 2024 vs only 5.3m in 2023, a 481% growth rate!

- Cash was $21.6m on september 30 2024 vs $14.7m on december 31 2023, growing slowly but surely.

- They have no debt!

Seriously, what don’t you like in these metrics? They are growing (very) fast, getting closer and closer to full profitability (the already are Free cash flow positive which is what matters for a growing company) and no freaking debt!

For other metrics, please read their last earnings report, you’ll find everything you need!

What about their shares structure?

Here are the main metrics:

- Shares Outstanding: Approximately 189 millions (vs 180m in 2023). This small dilution is mostly explained with the distribution of shares to their agents as bonuses. This dilution is compensated by the share buyback program.

- Insider Ownership: A very healthy 21.3% percentage of shares are held by insiders, aligning management’s interests with shareholders.

- Institutional Ownership: The company is beginning to attract institutional interest with 44.6%, a positive signal for future stock performance. This will also bring less volatility to the stock.

The shares structure is healthy. I particularly love the fact that this is a founder lead company and that he has “skin in the game”!

Today, january 10, 2025, the share price is $4.26. It grew 134% in one year and we have good reasons to believe it will keep on increasing in the future!

The Management Team

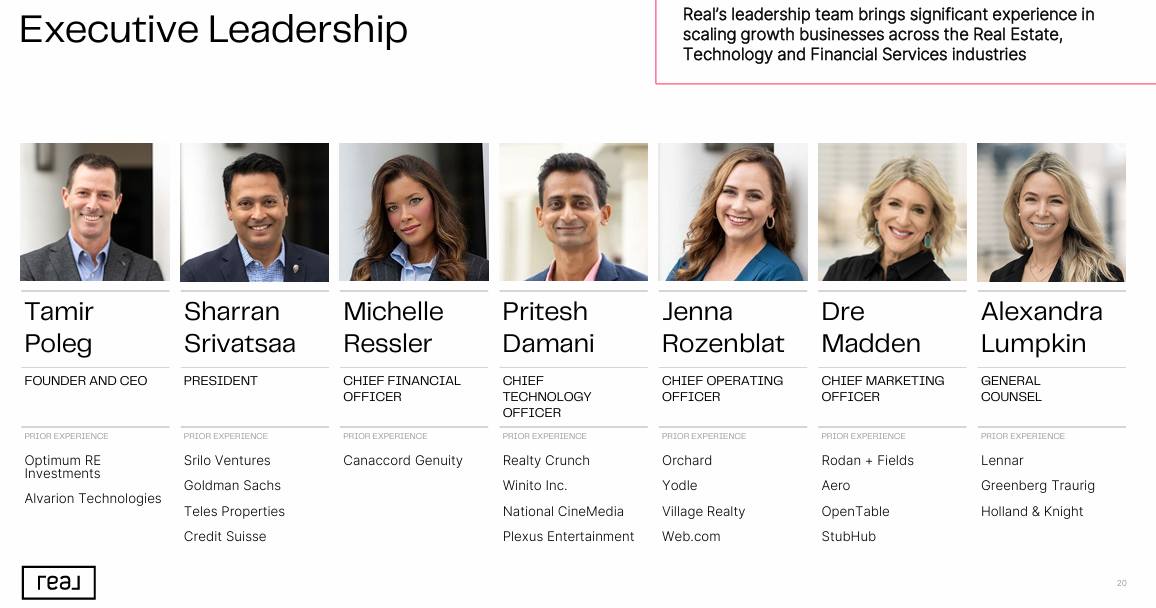

Real’s leadership team is a key factor in its success. The company is led by Tamir Poleg, its founder and CEO, who brings extensive experience in real estate and technology. Under his guidance, Real has focused on innovation and building a scalable business model. Tamir a very passionate and focus CEO! He is doing great job managing the company, even doing it completely remotely!

The management team includes seasoned professionals with expertise in real estate, technology, and finance. Their collective experience and strategic vision have been instrumental in driving the company’s growth and positioning it as a disruptor in the industry. I particularly like their CTO Pritesh Damani who brings a lot of new and innovative ideas on the table. Most of the new technologies integrated in the company come from him!

Conclusion

Well, it’s already time to wrap it up! I believe that The Real Brokerage Inc. is a very exiting investment opportunity for those looking to gain exposure to the evolving real estate industry. With its disruptive business model, strong growth trajectory, and focus on technology, the company is well-positioned to capitalize on industry trends. However, as any investment, potential investors should also weigh the risks, including competition and economic sensitivity.

This article is not financial advice, I only wrote what my thoughts were about this company. So don’t take my only advice to buy any stock!

This was “This Company is Changing the World of the Realtors”. So, did you like it? Tell us!

Do you like our deep dives? Check our other ones about High Tide, Gorilla Technology and Eos Energy.