What are trading trends?

Trading trends are patterns or tendencies that can be observed in the market over time. These trends can be identified by analyzing price movements, volume changes, and other indicators. There are three main types of trading trends:

1. Uptrend: An uptrend occurs when the market is moving upwards, with higher highs and higher lows being formed. Traders can capitalize on an uptrend by buying securities at a lower price and selling them at a higher price.

2. Downtrend: A downtrend occurs when the market is moving downwards, with lower lows and lower highs being formed. Traders can capitalize on a downtrend by selling securities at a higher price and buying them back at a lower price.

3. Sideways trend: A sideways trend occurs when the market is moving in a horizontal direction, with no clear direction being established. Traders can capitalize on a sideways trend by buying low and selling high within a specific price range.

How to identify trading trends?

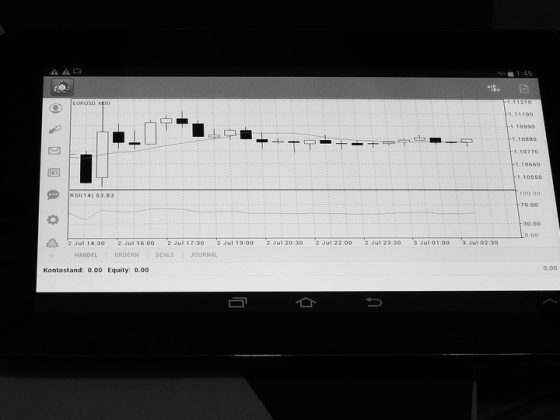

There are several ways to identify trading trends in the market. Technical analysis is a common method used by traders to analyze historical price data and identify patterns that can help predict future market movements. Some popular technical indicators used to identify trading trends include moving averages, relative strength index (RSI), and MACD (moving average convergence divergence).

Another way to identify trading trends is through fundamental analysis, which involves analyzing economic data, company financials, and market news to determine the underlying factors influencing market movements. By staying informed about the latest developments in the market, traders can better predict future trends and make informed trading decisions.

How to capitalize on market movements?

Once traders have identified a trading trend, the next step is to capitalize on it. There are several strategies that traders can use to profit from market movements, including:

1. Trend-following: This strategy involves buying or selling securities in the direction of the prevailing trend. Traders can use technical indicators to confirm the strength of the trend and enter trades at opportune times.

2. Counter-trend trading: This strategy involves betting against the prevailing trend and entering trades at reversal points. Traders can use technical indicators to identify potential turning points in the market and take advantage of short-term price movements.

3. Breakout trading: This strategy involves entering trades when the price breaks through a significant support or resistance level. Traders can use technical indicators to identify breakout opportunities and ride the momentum of the market.

In conclusion, trading trends play a crucial role in the success of traders in the market. By effectively identifying and capitalizing on market movements, traders can increase their chances of making profitable trades and achieving their financial goals. By using a combination of technical and fundamental analysis, as well as various trading strategies, traders can navigate the market with confidence and success.