Tempus AI, Inc. (NASDAQ: TEM) is shaking things up in the health tech world with its focus on AI-driven precision medicine solutions. Since making its public debut in June 2024, it’s grabbed a lot of attention from both investors and analysts. Here are three solid reasons why Tempus AI stock might just double your investment in 2025 (but remember, this isn’t financial advice):

1. Robust Revenue Growth and Market Potential

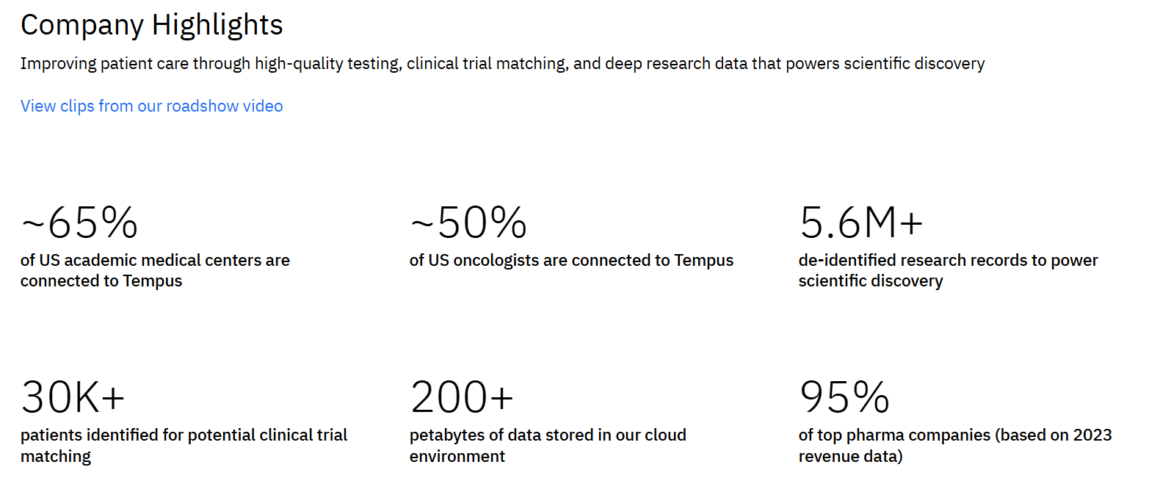

Tempus AI has demonstrated significant revenue growth, reporting approximately $693 million for the full year 2024, a 30% increase from the previous year. In the fourth quarter alone, the company achieved approximately $200 million in revenue, marking a 35% year-over-year increase. This upward trajectory is expected to continue, especially with the recent launch of the FDA-approved xT CDx test and the introduction of the xH whole-genome sequencing assay in January 2025.

Indeed, Tempus AI is aiming to generate approximately $1.23 billion in revenue for 2025, reflecting a growth rate exceeding 75% year-over-year (including Tempus and Ambry Genetics sales)!

2. Institutional Investments

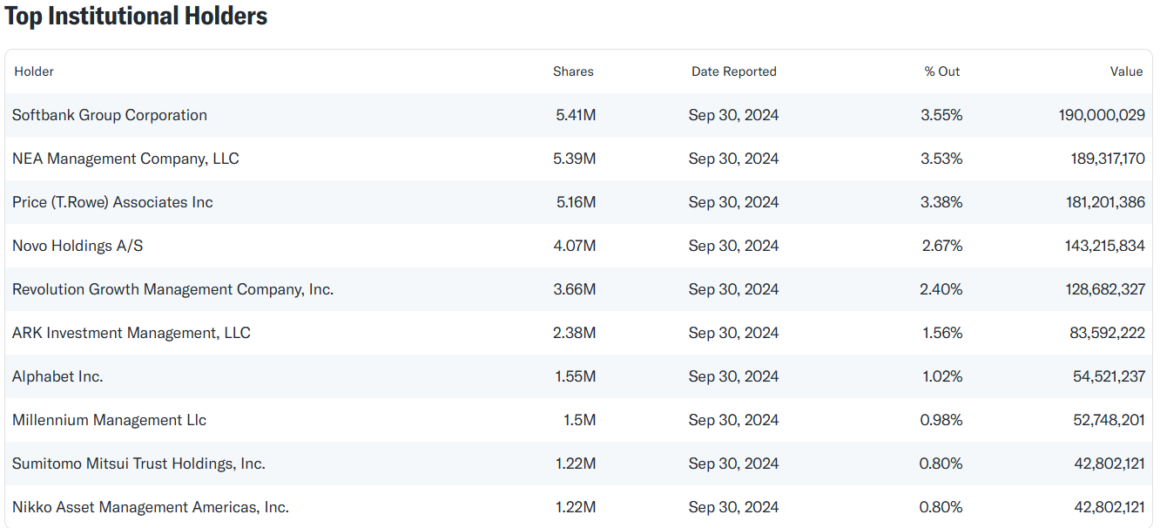

Tempus AI has attracted substantial institutional interest, reflecting confidence in its business model and growth prospects. Notably, Novo Holdings A/S acquired over 4 million shares, amounting to an investment of approximately $143 million, representing a 2.67% stake in the company. Additionally, Sculptor Capital LP purchased 145,289 shares valued at approximately $5.09 million. Despite these new purchases, Tempus AI currently has institutional ownership of less than 40%. This relatively low level leaves significant room for new institutional investors to enter. If more institutions begin accumulating shares, this could create considerable upward pressure on the stock, further enhancing its value. Increased institutional participation would also signal broader market confidence in Tempus AI’s long-term potential.

Top institutional holders of TEM stock

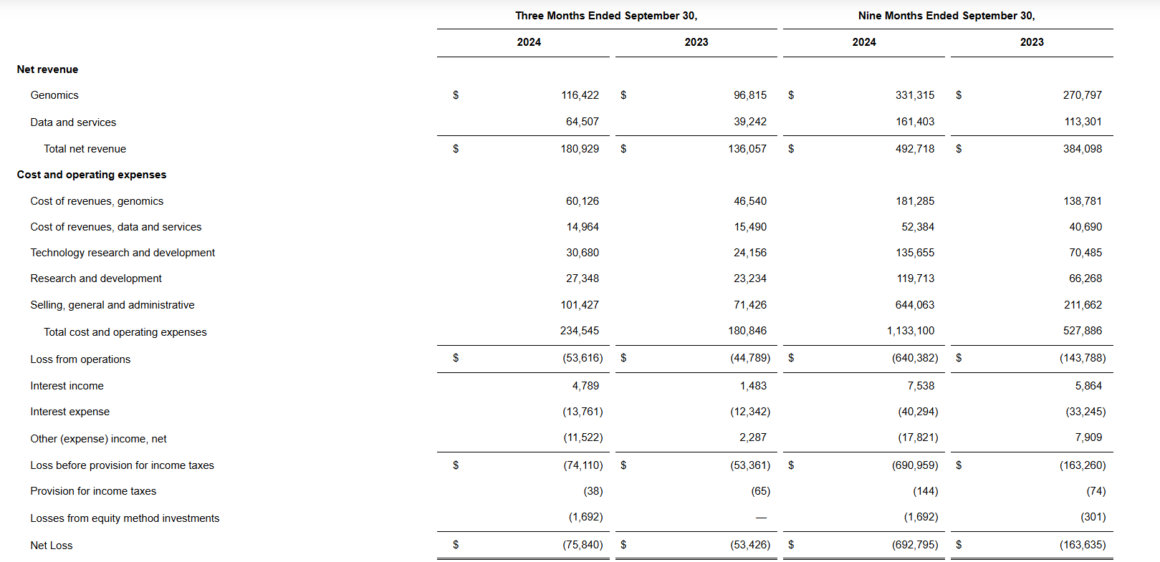

3. A Clear Path to Profitability

Throughout 2024, Tempus AI consistently improved its adjusted EBITDA quarter-over-quarter, signaling a steady march toward profitability. With growing revenues and a disciplined focus on operational efficiency, Tempus estimates that they will achieve positive adjusted EBITDA and free cash flow in 2025—key milestones that could significantly boost investor confidence.

Conclusion: A Humorous Catalyst to Watch

Tempus AI is uniquely positioned for explosive growth in 2025, thanks to its strong revenue trajectory. But if these reasons aren’t convincing enough, consider this: none other than Nancy Pelosi, a name synonymous with uncanny market timing, has reportedly bought calls on Tempus AI stock on january 17th, 2025. If history is any guide, this could be the ultimate “wink” from the universe that Tempus is heading for the stratosphere. As the internet often jokes, when Pelosi gets involved, it might be time to “follow the money!”

Of course, as with any investment, perform your due diligence—because even the savviest bets come with risks (and not everyone has a crystal ball like Pelosi’s). This article is not financial advice

This was “3 reasons Tempus AI Could Double Your Money in 2025”. Did you like it? Tell us!