Gorilla Technology is a company that consistently surprises with its innovative AI solutions. Their recent $50-60 million contract with the Bangkok police is just one example of their growing influence. Despite their impressive track record, Gorilla remains undervalued, making it an intriguing opportunity for investors. Let’s dive into the 3 catalysts that could push Gorilla Technology’s stock to $50!

1. The $430 Million Contract in Southeast Asia

One of the most significant drivers of Gorilla Technology’s future success is its soon to be announced $430 million contract in Southeast Asia. This transformative deal would position the company as a major AI security player in the world.

This contract would not only solidifies Gorilla’s revenue pipeline but also open doors to future opportunities in a rapidly growing market. Investors can expect that this deal would boost the company’s financials significantly in the coming quarters, setting the stage for its stock price to soar. Imagine that, a $430m contract for a $250m market cap company…

2. AWS Partnership: A Strategic Game-Changer

Gorilla Technology’s partnership with Amazon Web Services (AWS) is another catalyst with massive potential. As AWS continues to dominate the cloud computing space, Gorilla Technology’s alignment with the tech giant enhances its credibility and market presence.

What many investors don’t know is that they already have a partnership with AWS! The collaboration focuses on integrating Gorilla’s advanced AI and video analytics solutions with AWS’s robust cloud infrastructure. This partnership allows Gorilla to scale its offerings globally, tap into new markets, and deliver seamless, cloud-based solutions to its clients. Furthermore, the partnership signals to investors that Gorilla is playing in the big leagues, leveraging AWS’s brand and resources to accelerate growth.

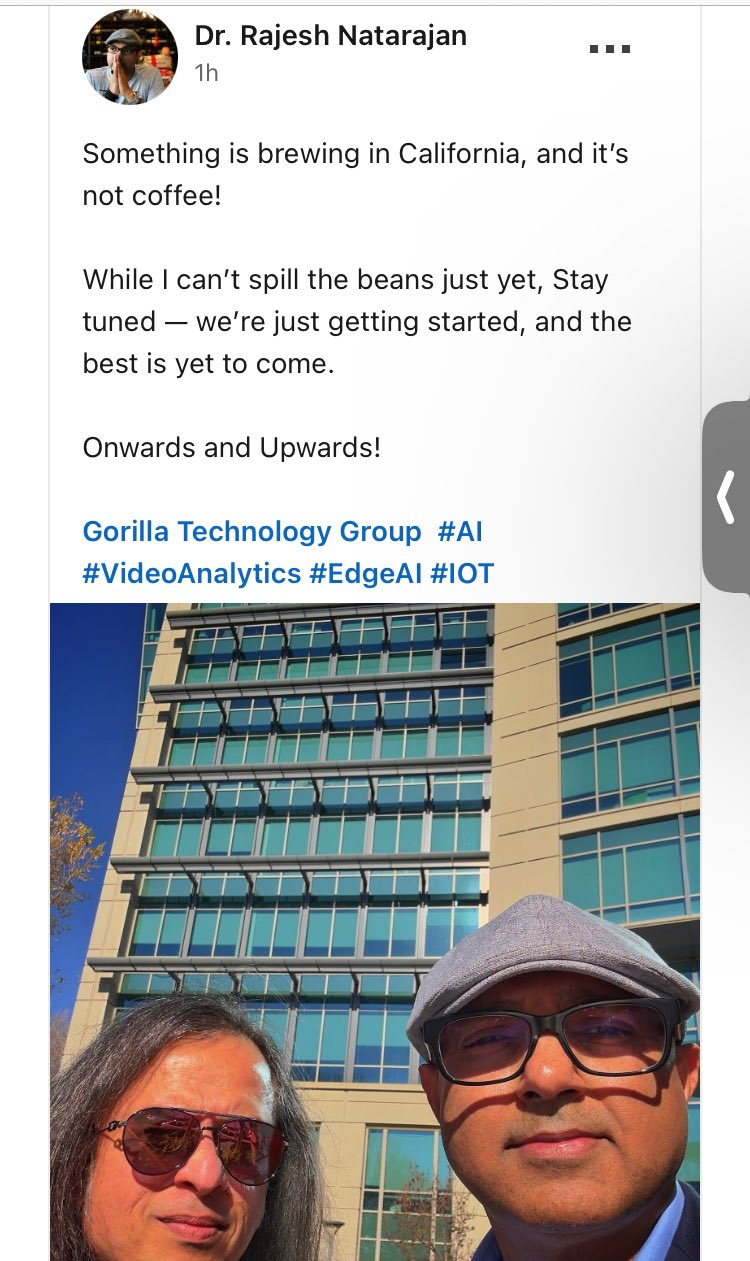

But adding fuel to the speculation around Gorilla Technology’s growth is a cryptic but intriguing post from CTO Dr. Rajesh Natarajan last month. In the post, he hinted at “something brewing in California,” paired with hashtags like #AI, #VideoAnalytics, and #IOT. While details remain under wraps, this could be a subtle nod toward a deepening partnership with AWS or another game-changing development.

If this collaboration with AWS expands further, it could mean Gorilla’s solutions being more tightly integrated into AWS’s ecosystem, potentially opening the doors to a flood of new enterprise clients! This type of strategic move could redefine Gorilla’s market positioning and drive significant momentum in its stock price.

3. Increased Institutional Ownership and a Potential Short Squeeze

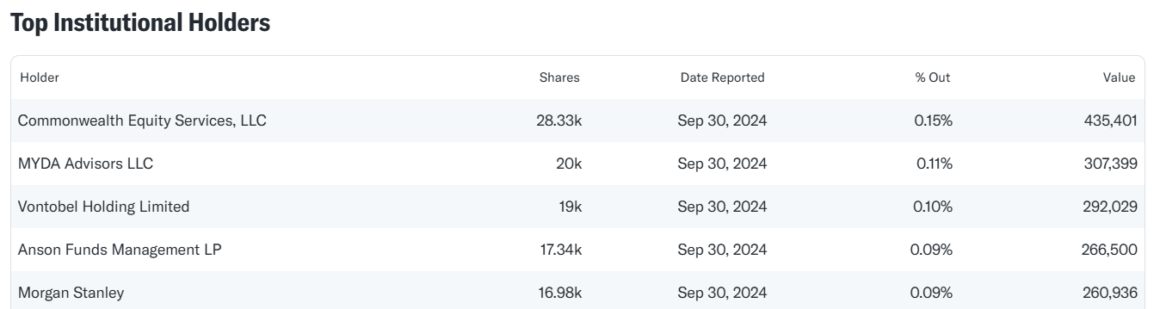

The final catalyst lies in the dynamics of the stock market itself. Gorilla Technology has recently seen a noticeable uptick in institutional ownership, as more hedge funds and mutual funds recognize the company’s potential. Nevertheless, the institutional ownership remains extremely low for a public company, at only 5% of the float. f more institutions begin investing, it could serve as a significant catalyst for the stock while also helping to reduce its volatility.

Additionally, Gorilla Technology has a high short interest, making it a prime candidate for a short squeeze. If positive news, such as the Southeast Asia contract or AWS partnership, were to drive the stock higher, short sellers could rush to cover their positions, triggering a sharp upward price movement. This dual force of institutional buying and a short squeeze could catapult the stock to unprecedented levels.

The Path to $50: A Perfect Storm

The combination of a transformative $430 million contract, a strategic partnership with AWS, and favorable stock market dynamics makes Gorilla Technology an explosive investment opportunity. As these catalysts unfold in the next few months, the stock’s current undervaluation could become a distant memory.

For investors, Gorilla Technology represents a thrilling mix of innovation, market disruption, and financial growth. While nothing in the market is guaranteed, the potential for this stock to hit $50 is very real. Buckle up—this ride could be wild!

This was “3 Catalysts That Could Push Gorilla Technology Stock to $50”, did you like it? Tell us!

Do you like Gorilla Technology, check up our deep dive on this amazing company!

This is not financial advice, do you own DD!